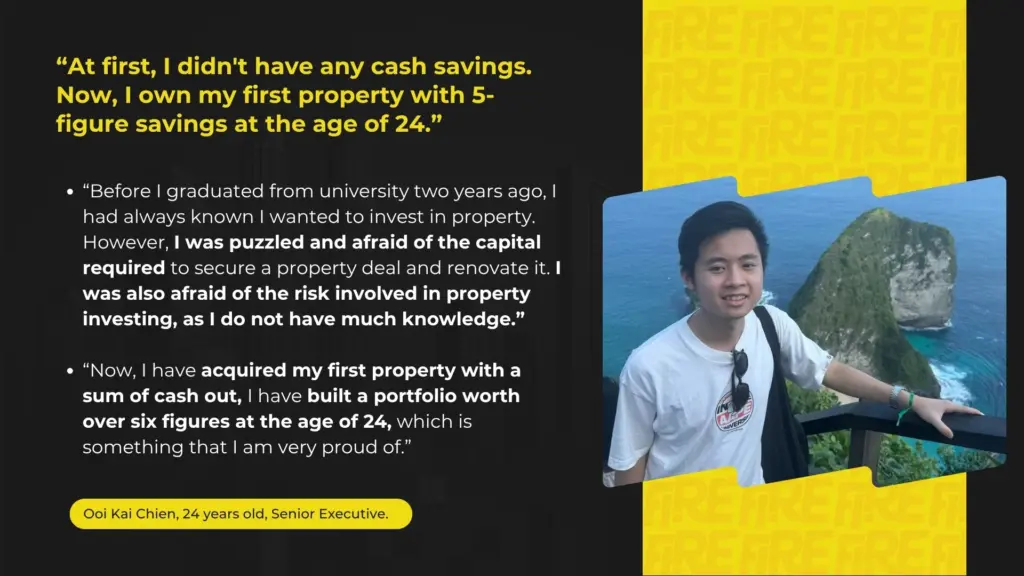

At just 24 years old, Ooi Kai Chien from Selangor has achieved what many professionals twice his age are still figuring out — combining property investment with stock investing to accelerate his financial independence.

But the journey didn’t start with confidence. It started with fear.

Like many fresh graduates, Kai Chien had ambitions to build wealth early but little clarity on how to start.

“I always knew I wanted to invest in property to achieve financial independence. But I was afraid of the capital required and the risks involved. I had no experience, no cash savings, and no real knowledge of the property market.”

The idea of property investment felt out of reach, something reserved for older, established professionals with large salaries and plenty of cash. Everything changed when he found FAR Capital.

Kai Chien joined FAR Capital shortly after entering the workforce, attending multiple sessions including WDIB, client webinars, and Sunday property workshops.

“Through those sessions, I learned what I didn’t know before — how to analyze deals, understand risk, and see property as a tool rather than a trap,” he said.

He was also guided by a dedicated Success Manager and supported by a thriving investor community — something he describes as invaluable.

“I realized that property investing isn’t as daunting as it looks when you have the right system, data, and people around you.”

Within a short time, Kai Chien acquired his first property through FAR Capital — a milestone that came with a powerful outcome: cashback exceeding RM30,000.

But instead of spending it, he made a strategic move.

“I invested the cashback into the stock market early this year and earned more than 20% returns. Combined with the capital I consistently invest monthly, my portfolio is now worth over six figures at the age of 24,” he said proudly.

The combination of cashflow and cashback from property with high-growth stock investing created the perfect balance between defensive and offensive strategies — a mindset shift that Kai Chien attributes fully to FAR Capital.

For Kai Chien, property has become the foundation of his financial freedom strategy.

“Property investment is my defensive stronghold — it gives consistent, predictable cashflow that protects me from stock market volatility,” he explained.

“Meanwhile, the cashflow and cashback are my offensive force, fueling my high-growth stock market strategy.”

This balanced approach gives him both stability and momentum — a mix that’s rare for someone his age.

Through FAR Capital’s structured system, Kai Chien didn’t just buy property — he built a long-term strategy.

From the regular webinars to the intensive data-backed property studies, he gained the confidence to act with clarity, not fear.

“The knowledge, opportunity, and mindset that FAR Capital has instilled in me have changed my financial life for the better,” he said.

“Be open-minded to what FAR Capital offers. It might sound unbelievable at first, but once you understand it, you’ll thank your past self for taking the leap.”

Kai Chien’s next milestone is clear: to achieve RM3,000–RM5,000 in cumulative passive income within five years through both property and stock investing.

His strategy is simple — keep investing in the stock market where he’s skilled, while leveraging FAR Capital’s deals and data to grow his property portfolio safely.

At 24, he’s already living proof that the right knowledge can collapse decades into years.

“FAR Capital gave me clarity, structure, and the right mindset. It turned fear into confidence and a dream into a real financial plan.” — Ooi Kai Chien, 24, Senior Executive (Selangor)

✅ From zero savings and fear of risk to owning property, RM30K cashback, and a six-figure portfolio — Kai Chien’s story shows that financial independence is possible when you combine the right education with action.

👉 Ready to start your own journey?

Join the FIRE Event and learn how young investors like Kai Chien are building real wealth through property: https://fire.farcapital.com.my/