Buy property in Malaysia with confidence by following our comprehensive guide to the current market landscape. Whether you are a first-time homebuyer or an international investor, understanding the nuances of the Malaysian real estate market in 2026 is the key to securing high yields and long-term capital appreciation.

While Malaysia is a land of opportunity, treating every state the same is the fastest way to turn a “golden investment” into a stagnant asset. Malaysia is not a monolith; it is a collection of distinct markets, each with its own “flavor,” legal rules, and economic engines.

To win in this game, you must understand that where you buy is just as important as how much you pay.

Investing in property is like choosing a life partner. You don’t just look for “good looks” (the facade of a building); you look for stability, growth potential, and whether they can support your lifestyle (rental yields and capital appreciation).

In this chapter, we will dissect the four “Kings” of the Malaysia property market: Kuala Lumpur, Selangor, Penang, and Johor Bahru, to see which one aligns with your investment DNA.

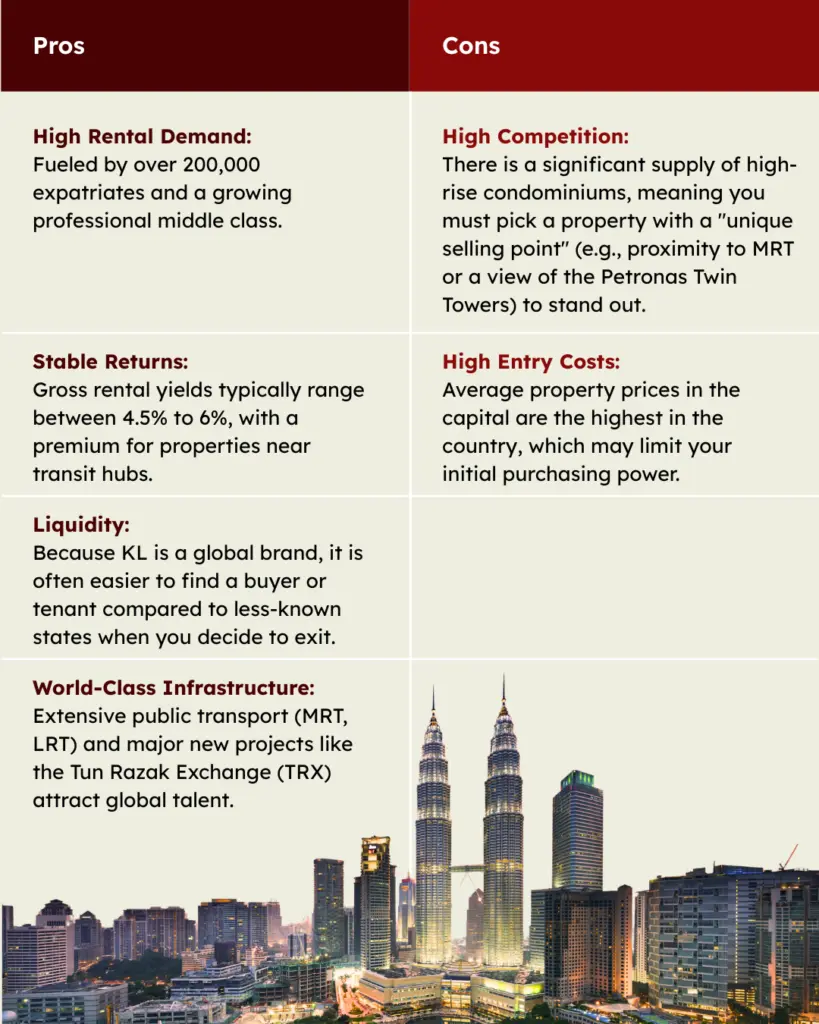

If Malaysia is the body, Kuala Lumpur is the heart. It is the financial center, the primary choice for multi-national corporations (MNCs), and the ultimate destination for expatriates seeking a metropolitan lifestyle.

Often overlooked in favor of its neighbor KL, Selangor is the richest and most developed state in Malaysia. It is the industrial backbone of the nation, home to massive logistics hubs and the rapidly growing data center sector.

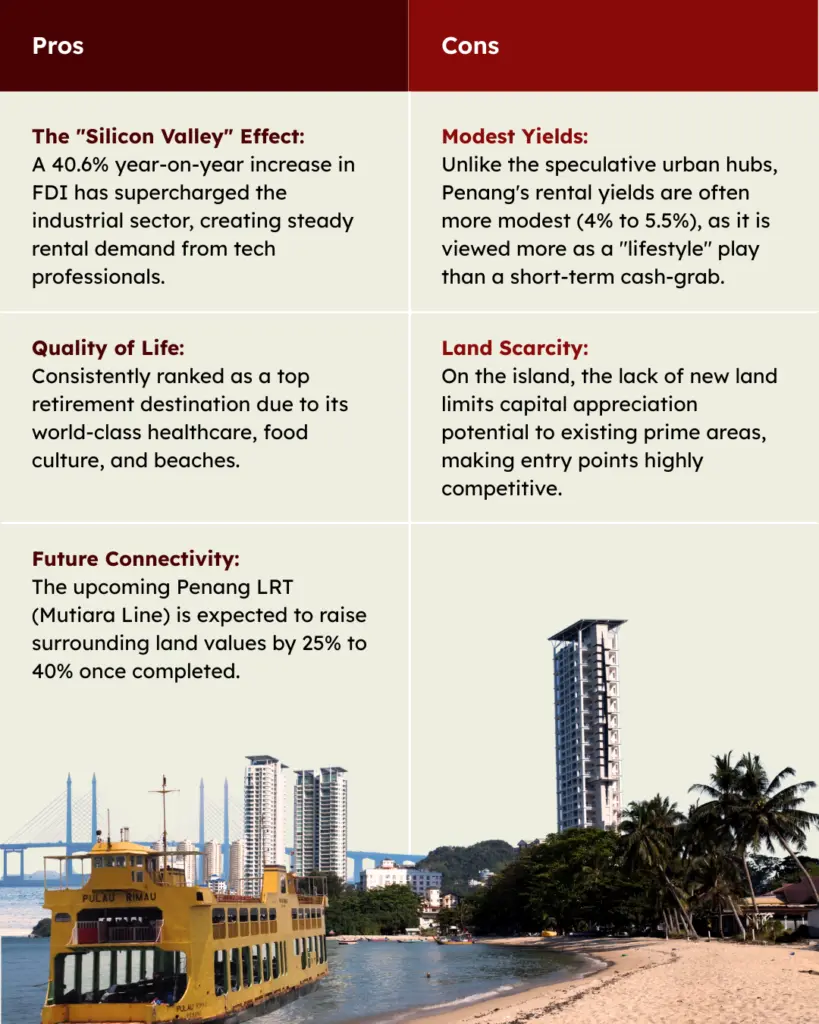

Penang is a dual-faceted market. On one side, you have the historic UNESCO World Heritage site of George Town; on the other, a high-tech manufacturing hub often referred to as the “Silicon Valley of the East.”

If you are looking for the highest potential upside, JB is the name on everyone’s lips. Its market is intrinsically linked to Singapore, making it a hotspot for cross-border commuters and “spillover” wealth.

When you decide to buy property in Malaysia, you must navigate the National Land Code. Foreigners are generally restricted from:

- Malay Reserved Land.

- Low-to-Medium Cost Housing.

- Bumiputera Lots.

For more details on international ownership laws, visit the Official Malaysia Government Portal or consult with NAPIC for historical price data. These DoFollow resources are essential for due diligence.

Pro Tip: Look for “Transit-Oriented Developments” (TODs). These projects are designed specifically to integrate with public transport, making them the most resilient assets during economic shifts.

Conclusion: Your Next Move

To buy property in Malaysia is to invest in one of Southeast Asia’s most resilient economies. Whether you seek the stability of Kuala Lumpur or the high-growth potential of Johor Bahru, the 2026 landscape offers unique opportunities for those who do their homework.

The Golden Rule: Always align your location with your exit strategy.