Foreigners: Property investment in Malaysia is a journey that begins with a single question: Is every property a “good deal”?

Absolutely not. Finding a property that meets the state’s minimum price threshold is only the first step. To truly succeed as a foreign investor, you need to filter out the noise and identify the “star performers” that will actually generate wealth.

In 2026, the Malaysian real estate landscape has evolved. With the new 8% flat stamp duty for foreigners and the updated tiered MM2H visa system, your strategy must be sharper than ever.

This guide provides the exact 8-criteria framework we use at FAR Capital to protect your capital and ensure your asset is a high-yielding engine.

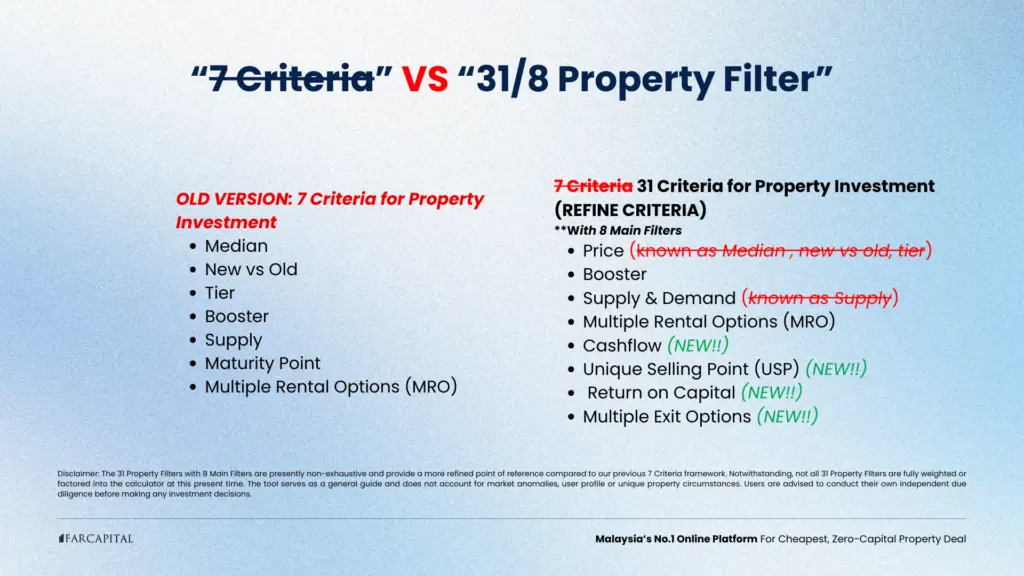

At FAR Capital, we don’t rely on guesswork. We have transitioned from an “Old Version” of 7 basic criteria to a highly refined 31 Property Filter system.

This data-driven approach is designed to provide an independent POV for those looking to buy an investment property and uncover incorrect facts often used to sell these assets.

Our goal is to use data to provide an independent guide for anyone looking to buy, ensuring that your property investment in Malaysia is based on cold, hard facts rather than developer marketing.

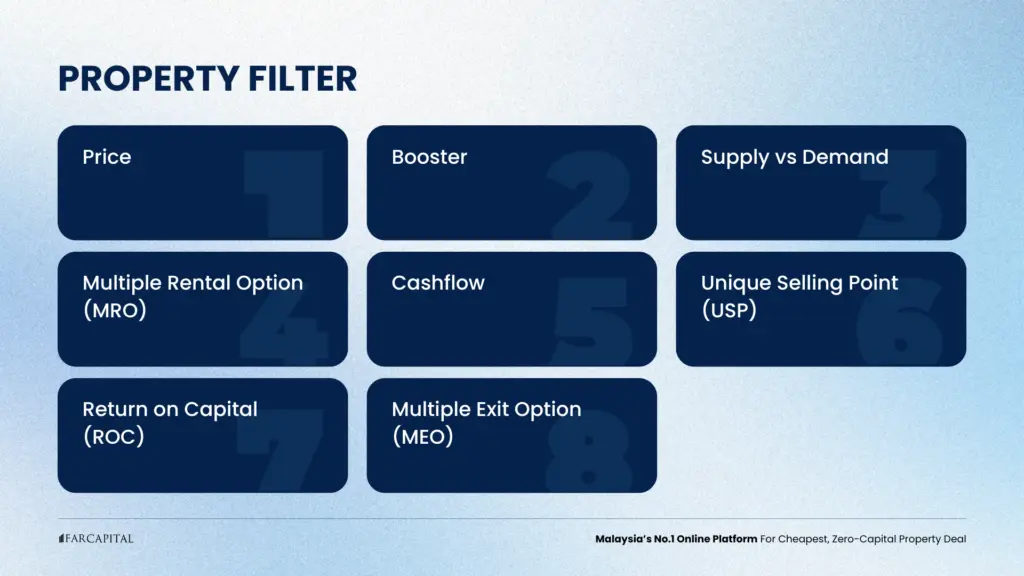

Rather than overwhelming you with all 31 technical points, we have condensed our framework into 8 Main Filters. Before we even consider a property investment in Malaysia, it must pass through our 8 Property Filters.

These filters are designed to protect your capital and ensure that your asset isn’t just a “pretty building,” but a high-yielding engine.

Because seeing these filters in action is far more impactful than reading about them, we have prepared a dedicated masterclass for you.

“We have condensed years of market experience into this 8-step filtering process. This is the exact strategy we use to find hidden gems and avoid the common pitfalls that 90% of foreign investors fall into.”

Apart from 8 property filters, we also mention about Tier 1 areas. While you can technically buy property in almost any state, a smart investor doesn’t spread themselves thin.

For property investment in Malaysia, Tier 1 areas are the only regions that focus on prime expats, low local occupancy, and “trophy” status. Why? Take a look at the table below.

To summarize, understanding the tiers will help you decide where to allocate your property investment funds in Malaysia.

Choosing the wrong tier is the fastest way to stall your portfolio growth. Most foreign investors fall into the trap of buying “cheap” Tier 3 properties, only to find no tenants available.

| Feature | Tier 1 (Prime) | Tier 2 (Established) | Tier 3 (Suburban) |

| Primary Audience | High-income Expats | Local Owner-Occupiers | Rural/Suburban Locals |

| Location | CBD / Prime Hubs | Near CBD (Cheras, Setapak) | Outer Ring (Rural) |

| Rental Demand | Very High | Stable (Local demand) | Low/Weak |

Investing in Malaysian real estate as a foreigner is highly lucrative, provided you don’t treat it like a hobby. By sticking to Tier 1 areas and applying our 8 Main Filters, you transform a risky purchase into a strategic wealth-building tool.

Stay grounded, look at the data, and always prioritize “Location Gravity” over aesthetic appeal.