Malaysia’s Property Market is currently experiencing a transformative era. For Singaporeans looking across the Causeway or expats seeking a stable haven, the landscape in 2026 is no longer just about “cheap land”. It is about high-tech connectivity, world-class infrastructure, and a favorable exchange rate that maximizes purchasing power.

Is every place in Malaysia suitable?

The short answer is: No.

While Malaysia is a land of opportunity, treating every state the same is the fastest way to turn a “golden investment” into a stagnant asset. Malaysia’s Property Market is not a monolith; it is a collection of distinct markets, each with its own “flavor,” legal rules, and economic engines.

To win in this game, you must understand that where you buy is just as important as how much you pay.

Investing in property is like choosing a life partner. You don’t just look for “good looks” (the facade of a building); you look for stability, growth potential, and whether they can support your lifestyle (rental yields and capital appreciation).

With the Singapore Dollar remaining strong against the Ringgit, Malaysia’s Property Market offers a “lifestyle arbitrage” that few other countries can match. Whether you are an expat working in the Klang Valley or a Singaporean professional eyeing the upcoming RTS Link, the value proposition is undeniable.

In this chapter, we will dissect the four primary regions dominating Malaysia’s Property Market: Kuala Lumpur, Selangor, Penang, and Johor Bahru. Each area serves a different “investment DNA.”

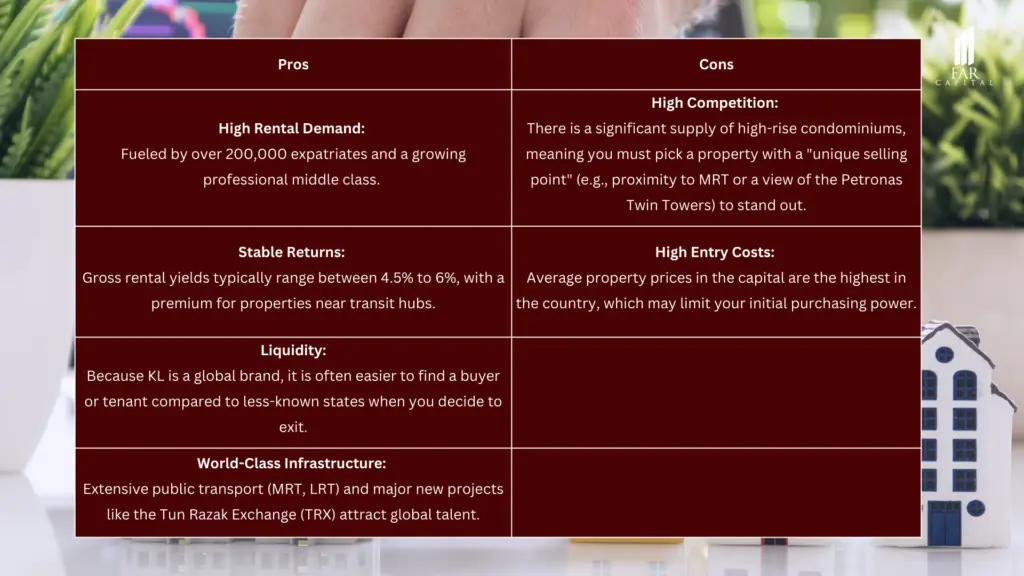

If Malaysia is the body, Kuala Lumpur is the heart. It is the financial center, the primary choice for multi-national corporations (MNCs), and the ultimate destination for expatriates seeking a metropolitan lifestyle.

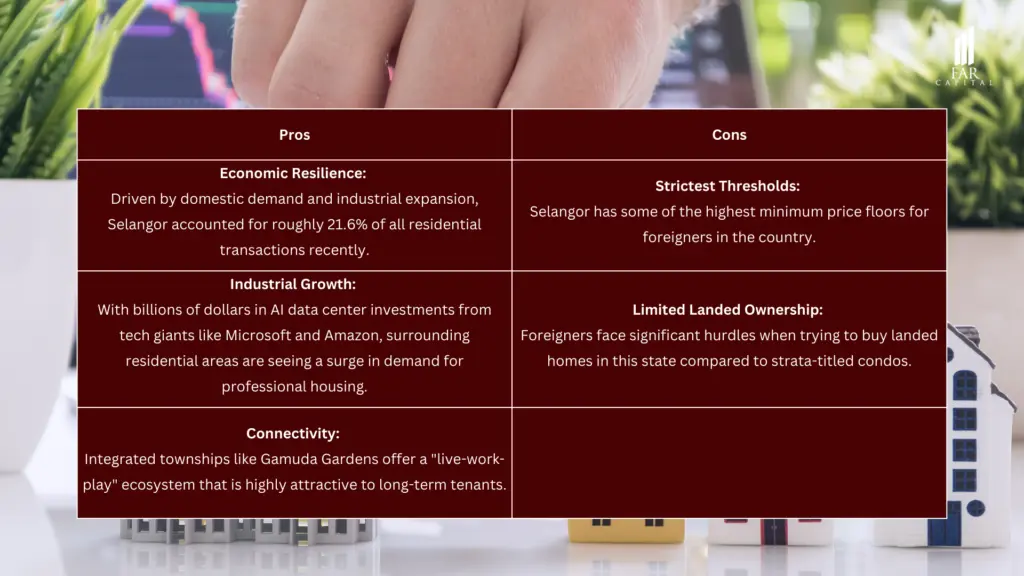

Often overlooked in favor of its neighbor KL, Selangor is the richest and most developed state in Malaysia. It is the industrial backbone of the nation, home to massive logistics hubs and the rapidly growing data center sector.

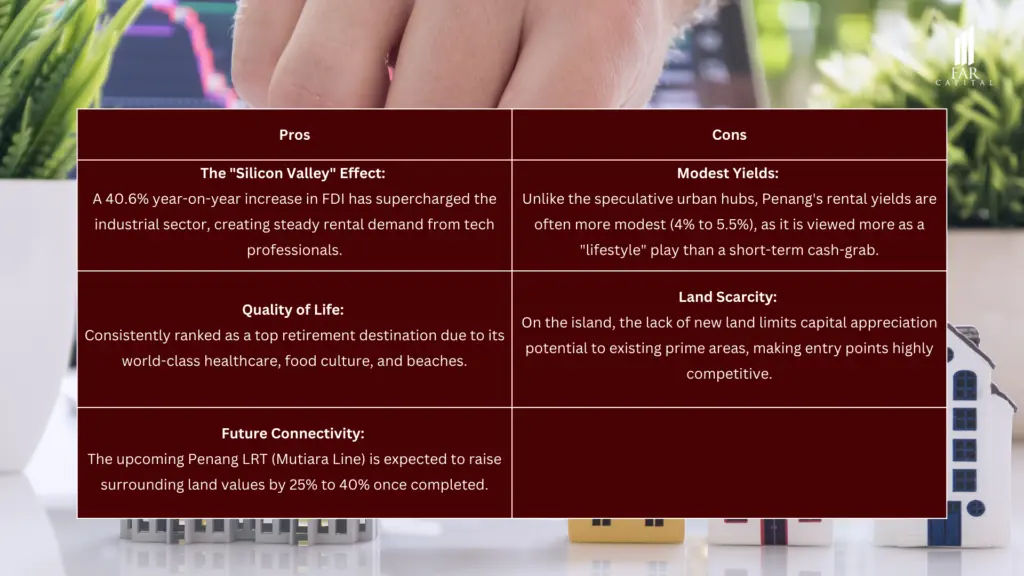

Penang is a dual-faceted market. On one side, you have the historic UNESCO World Heritage site of George Town; on the other, a high-tech manufacturing hub often referred to as the “Silicon Valley of the East.”

If you are looking for the highest potential upside, JB is the name on everyone’s lips. Its market is intrinsically linked to Singapore, making it a hotspot for cross-border commuters and “spillover” wealth.

Understanding the legalities is crucial for any foreigner. Since 2026, the Malaysian government has streamlined certain processes, but state-level restrictions remain.

| State | Strata Threshold | Landed Threshold |

| Kuala Lumpur | RM 1,000,000 | RM 1,000,000 |

| Selangor | RM 1,000,000+ | RM 2,000,000 |

| Penang (Island) | RM 1,000,000 | RM 3,000,000 |

| Johor | RM 1,000,000 | RM 1,000,000+ |

Note: As of January 2026, a flat 8% Stamp Duty applies to foreign buyers for residential property transfers. However, many developers offer packages to absorb some of these entry costs.

For a detailed breakdown of the MM2H (Malaysia My Second Home) tiered system and how it affects your purchase, refer to our internal guide on MM2H Property Requirements 2026.

Malaysia’s Property Market offers a unique window of opportunity for those who act with precision. Whether you are seeking the capital stability of Kuala Lumpur or the explosive growth of Johor Bahru, the key is to align your location with a clear exit strategy.

As the regional economy integrates further, the “Four Kings” will continue to lead the way. Don’t just buy a house; buy into a future economic engine.