Imagine you are at a high-stakes family reunion. In the center of the room stands the superstar cousin: Singapore. Polished, wealthy, and the envy of every eye in the room. Then, sitting quietly in the corner is Malaysia.

For decades, the world has looked at Malaysia as the “ugly distant cousin”. We might be less polished, less “good-looking” on the global stage, and perhaps a bit rougher around the edges.

But in the world of investment, the “pretty” option is often the one that has already peaked. While Singapore is a finished masterpiece, Malaysia is your second home, the masterpiece in progress, with the real estate market remaining stable, offering opportunities for capital appreciation and high rental yields, particularly in major cities like:

Right now, many expats are discovering that Malaysia is their second home, where they can enjoy a high standard of living without breaking the bank. Investing in real estate here, where Malaysia is your second home, allows for greater potential for appreciation and returns.

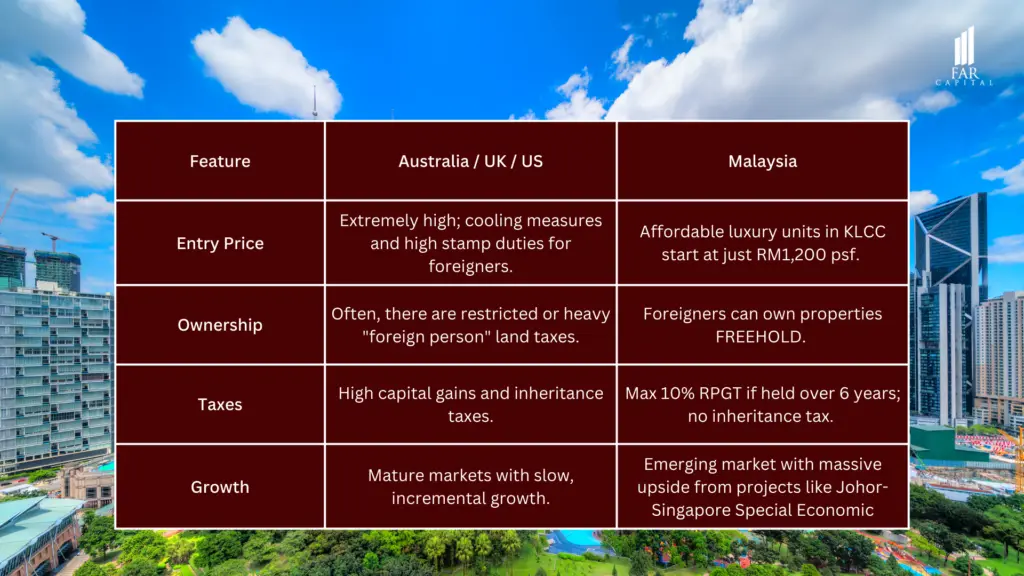

Now, let’s take a closer look at Malaysia and other countries.

For many foreign investors, Malaysia is your second home that offers lucrative returns and a friendly environment, a place where you can enjoy stability and growth.

For years, the “safe” narrative told investors to park their money in Australia, the UK, or the US. But stories change. In 2026, those mature markets have become fortresses of high entry barriers, cooling measures, and aggressive “foreign person” taxes.

When we look at the facts, Malaysia offers a level of freedom that those “giants” can no longer provide. Imagine owning a piece of a capital city’s heart, not just as a tenant or a leaseholder, but with FREEHOLD ownership.

While a modest apartment in London or Sydney might cost you a fortune in hidden stamp duties and maintenance, a “Tier 1” luxury unit in the KLCC or Bukit Bintang corridor or the Tun Razak Exchange (TRX) is still available starting from just RM1,200 per square foot (psf). (We’ll explain later what Tier 1 means).

For those seeking medical care, Malaysia is your second home, providing world-class healthcare services at affordable prices.

Yes, the world’s perception is shifting. Many foreign investors instinctively look toward Australia, the UK, or the US. But when you peel back the layers, the “safe” Western bet isn’t as lucrative as it used to be. Many retirees find that “Malaysia is your second home”, where they can live comfortably and affordably.

Here is a comparison that you can see:

To understand why Malaysia is a golden opportunity, you have to look at how the world’s elite: the investors, the retirees, and the medical experts, actually see “Malaysia is your second home” today.

The Medical Tourism Crown (We are #1!)

The Economic Momentum: Outperforming the Pack

While the “ugly cousin” narrative persists among the uninformed, the global financial institutions are betting big on Malaysia’s resilience.

Retirees from the UK, Australia, and Hong Kong are making a discovery that is driving property prices: Your life in Malaysia is “Singapore-lite” for a “Malaysia-price.”

The bottom line is we are no longer the “risky” option; we are the stability play. Malaysia is your second home, providing a unique lifestyle that many crave.

With Visit Malaysia Year 2026 (VMY2026) targeting 47 million visitors and a massive RM329 billion in receipts, the window to buy before the “ugly cousin” is fully recognized as the “global star” is closing fast.

You’ve heard the story that the Malaysian Ringgit (RM) is weak. But if you only listen to the surface noise, you miss the true melody of the market. A smart investor doesn’t just look at the price of a currency; they look at its purchasing power and its performance against the field.

When we zoom out and look at the last three years (2023–2026), a very different story emerges. While the US Dollar (USD) has been the global bully, the Ringgit hasn’t just been taking hits.

It has been quietly outperforming some of the most “stable” currencies in the world, including the Australian Dollar (AUD), New Zealand Dollar (NZD), and the Japanese Yen (JPY).

The Great Currency Stand-off (2023–2026)

To understand why Malaysia is a “buy,” you have to see what happened to the people who put their money elsewhere.

There was a trend where Singaporeans would rush to buy old terraced houses in the UK or condos in the US, thinking the “Western Dream” was the only way to beat inflation. The attraction has always been rooted in a few key “storylines” that Singaporeans find hard to resist.

While the idea of owning a flat in London or a house in the US sounds prestigious, the operational reality can be a headache. The management trap, tax complexity, and currency exposure.

Unlike Malaysia’s straightforward 10% RPGT after 6 years, the UK and US have complex tax regimes. In the UK, non-residents are taxed on rental income at roughly 20%, and they still face a 2% stamp duty surcharge for being non-residents.

Many Singaporeans are realizing that while the US and UK are “safe,” they are mature markets where the explosive growth has already happened. You are buying the “peak.” Malaysia, by contrast, offers the same transparency and similar laws but at an entry price that allows for much higher Return on Equity (ROE).

While the world was looking elsewhere, Malaysia was quietly climbing the ranks of global success. We aren’t just a place to buy “cheap” property; we are a global destination that is consistently topping the charts in ways most people ignore.

In summary, for those seeking a retreat, Malaysia is your second home in the serene landscapes of Southeast Asia.

#1 in the World for Medical Tourism

A Top 10 Retirement Paradise

If you want to know where the smart money lives, look at where the world chooses to retire.

Surprising Economic Momentum

The Bold Truth:

We might not be the “best looking” in the family. But history proves that whenever Singapore does well, we are the ones who benefit the most.

As our neighbor grows more expensive, the overflow of wealth, talent, and industry is coming straight to us. Once you experience it, you’ll see why Malaysia is your second home, cherished by many.