In the world of property investment, “location, location, location” is a tired cliche. In 2026, the real mantra is “connectivity, connectivity, connectivity.” At Far Capital, we have analyzed the shifting demographic of the Klang Valley to develop a property framework for predictable rental income: The 1/8 Theory, which ultimately impacts rental yield.

The 1/8 Theory is crucial to understand the dynamics of rental yield in the Klang Valley, as it directly correlates with areas of high population density and connectivity.

The math is simple, but the implications are massive. The Klang Valley is home to approximately 9.8 million people. However, daily ridership for public transport hovers around 1.19 million. This reveals that roughly 1 out of 8 people (13.5%) in the region are “Transit-Reliant Professionals.”

Here are the summary stats you can refer to:

For the average person, this might seem like a minority. However, for the sophisticated investor, this 13.5% represents the most concentrated and high-quality tenant pool in Malaysia, significantly influencing rental yield. These are individuals who prioritize their time over car ownership, working in high-value Central Business District (CBD) areas like TRX and KLCC, and they are the primary drivers of the Transit-Oriented Development (TOD) Spillover Effect.

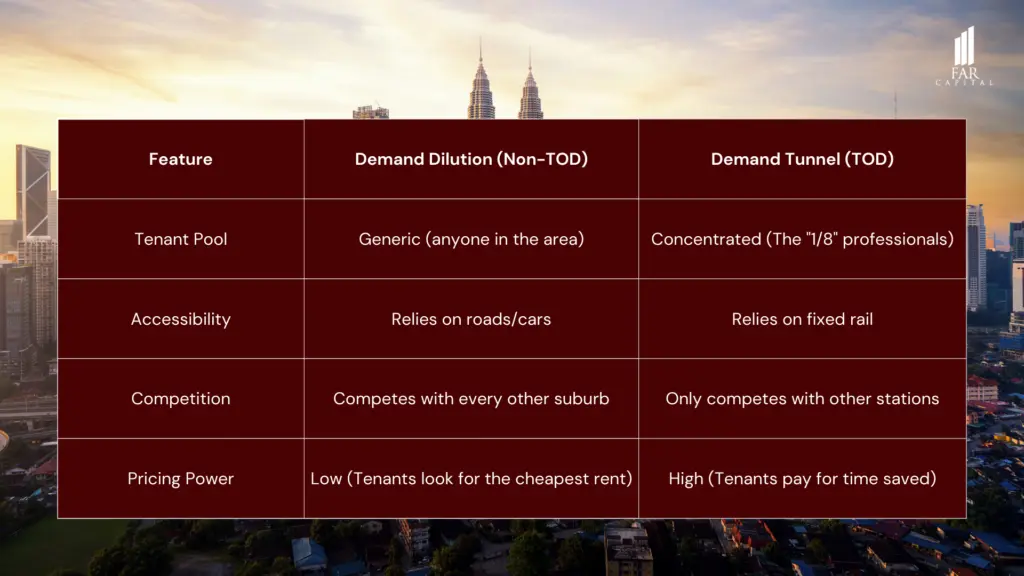

Most residential areas suffer from “demand dilution”. They rely on nearby amenities or school catchments, which can change. TOD, however, benefits from a “Demand Tunnel”.

Because 1.19 million people must move along fixed rail lines daily, demand is physically piped into any property connected to a station. While a normal condo in a quiet suburb might struggle with a 60% occupancy rate, a TOD property taps into a constant flow of commuters who cannot live elsewhere without sacrificing hours of their life to traffic jams.

While most investors wait for demand to find their property, TOD investors benefit from a “Demand Tunnel.” The MRT and LRT lines act as high-pressure pipes, moving 1.19 million potential tenants directly past your investment every single day. You don’t need to look for tenants; the infrastructure is already delivering them to you.

Take a look at the table below:

Therefore, investors should focus on these areas to maximize rental yield, as they are ideal for attracting professionals on a budget.

Understanding the spillover effect is fundamental for investors aiming to achieve optimal rental yield in the current market.

Based on this, we hypothesize that while the desire to live in the CBD (TRX/KLCC) is high, the actual occupancy is suppressed by extreme rental rates. A young professional earning RM5,000–RM8,000 cannot justify paying RM3,500 for a studio in KLCC.

This creates a Spillover Effect. The demand doesn’t disappear; it flows outward along the MRT and LRT lines. The further the station is from the CBD, the lower the rent becomes, but there is a breaking point where the commute time outweighs the cost savings.

Tenants are willing to travel further for lower rent, provided they stay within a specific timeframe (number of stations), adhering to the 1/8 demographic’s lifestyle.

This is where we find our investment tiers. Thus, using the distance from the workplace (CBD) as a benchmark, the rental demand creates a clear hierarchy, which we categorize as follows.

Zone A: The Sweet Spot (Within 8 Stations From CBD)

Zone A is the primary beneficiary of the spillover. These are areas like Cheras, Pandan Indah, or Sentul.

Zone B: The Value Play (8 – 15 Stations From CBD)

This zone includes areas like Kelana Jaya, parts of Petaling Jaya, and Sri Petaling.

Zone C: The “Budget Tier” (More than 15 Stations From CBD)

This covers the far ends of the lines, such as Kajang, Putra Heights, or Sungai Buloh.

Additional Zone S: The Luxury Core (Within the CBD area)

We generally exclude Zone S from this theory. This area is predominantly inhabited by expatriates and high-net-worth individuals. It is a “different game” where the rental yields are higher. It is a different game and a luxury segment.

The Tier 1 Constraint: Why “Near” is Not Enough?

In property investment, Tier 1 refers to the prestigious Central Business Districts (CBDs) like TRX and KLCC. While these areas command the highest premiums, they also create a natural barrier. The sheer cost of rental in the city center forces the bulk of the “1/8 population”, the 1.19 million commuters who rely on public transit, to search for housing further out.

However, this is where many investors get trapped. They buy in normal residential areas that are physically close to the city but lack rail access. Because these areas solve neither the price problem (they are still expensive) nor the congestion problem (you still have to drive), they suffer from “Demand Dilution”.

They fail to capture the spillover because they don’t offer the seamless lifestyle that transit-reliant professionals demand.

Even if you’re TOD, the closer you are to the city centre, the higher the rental premium is, mostly not affected by the TOD (LRT/ MRT stations), but coming from the land/ address premium. Those people staying in CBD mainly do not really rely on public transportation, but due to its address status. Mainly targeting expats to stay in CDB, locals mainly from Zone A-C (on TOD demand context).

The Station Rule (Spillover Demand): Distance vs Stops

The Station Rule is the ultimate game-changer for TOD investors. It proves that in the eyes of a modern tenant, demand is not measured in kilometers, but in stations. Traditional thinking says a house 5km from the city is better than one 10km away. The Station Rule proves the opposite.

Ultimately, understanding and optimizing the factors influencing rental yield will lead to a successful investment outcome.

Because this property solves the “Time-Cost” problem, it will consistently out-rent and out-occupy closer properties. In the new economy, tenants aren’t paying for square footage, they are paying for the minutes of their life they get back by avoiding the road.

Overall, the 1/8 Theory serves as a data-backed blueprint for modern property investors. It highlights a critical market reality: while only roughly 13.5% of the Klang Valley population relies on public transport daily, this specific group forms the most concentrated and reliable rental market for Transit-Oriented Development (TOD) projects.

These are not just commuters; they are a high-value demographic of urban professionals who prioritize efficiency and connectivity above all else.

Our research identifies the “Sweet Spot” for investment within Zone A areas located fewer than 8 stations away from the primary CBD hubs like TRX and KLCC. In this zone, investors can effectively capture 50% of the total market spillover. This spillover consists of thousands of white-collar tenants who work in the prestigious “Tier 1” city center but are priced out of its luxury rental rates.

By positioning your investment in Zone A, you offer the perfect compromise: a significantly lower rent with a commute time that remains under 20 minutes.

The most important takeaway for any savvy investor is understanding why Non-TOD properties fail, even if they are geographically close to the city. These properties suffer from “Demand Dilution” because they do not solve the fundamental “Time-Cost” problem. In a city notorious for gridlock, being 5km away by car is often slower than being 15km away by rail.

Ultimately, investing in a TOD is not a bet on the general real estate market; it is a strategic bet on the 1.19 million people whose lifestyles require efficient, jam-free mobility. By solving the “Time-Cost” equation for these tenants, you ensure high occupancy, resilient rental rates, and a future-proof investment portfolio.