At just 28 years old, Sean, a software engineer from Kuala Lumpur, was already earning well, but deep down, he was stuck in a loop familiar to many young professionals.

He was afraid of making the wrong move, buying the wrong property, or worse, losing money he couldn’t afford to lose.

Before joining FAR Capital, Sean had taken matters into his own hands.

“I spent three intense months researching, meeting agents, and negotiating deals. When I finally bought my first property in the sub-sale market, I was proud, but it came at a cost.”

That first property drained nearly all his savings, leaving him with minimal returns of just 5.8% ROI. There was no roadmap for scaling, no mentor to guide him, and no clear strategy.

“I felt like I hit a wall right after my first step,” Sean admitted. He had achieved something, but he had no idea how to move forward.

Sean joined FAR Capital out of curiosity — and a bit of desperation. What he found, however, was far more than a property service.

“Joining FAR Capital wasn’t just a turning point — it was a transformation,” he said.

Through 1-on-1 session with Success Manager and guided Property Tours, Sean learned the data-driven frameworks that separate emotional buying from strategic investing.

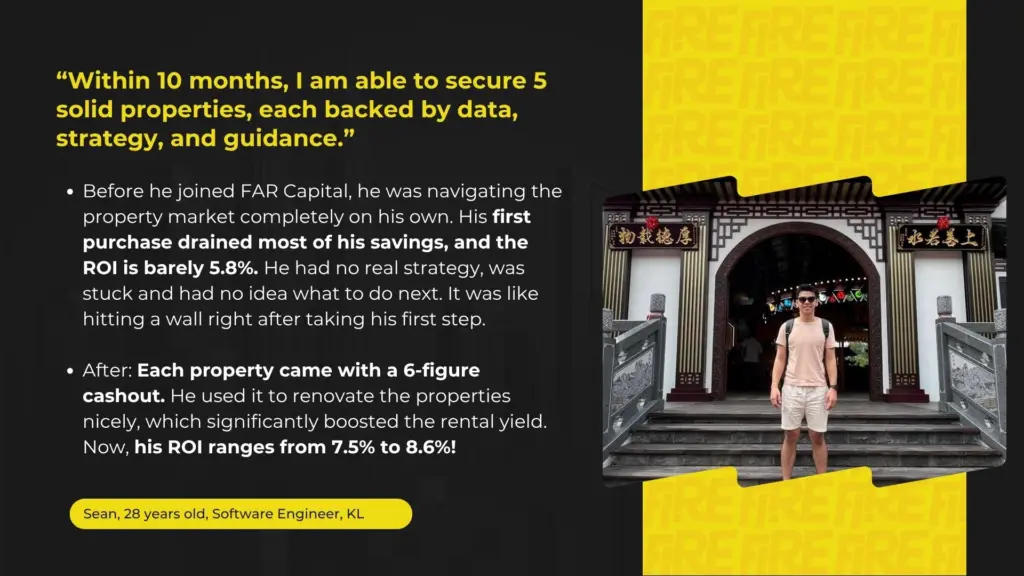

Within just 10 months, Sean secured five properties, each backed by due diligence, numbers, and professional guidance.

Each property Sean bought came with substantial cash out up to RM140,000 per unit. But unlike his past habits, he didn’t treat it as “free money.”

“FAR Capital taught me not to splurge on cars or vacations. Instead, I reinvested the cashback to renovate the units properly, increasing rental yields significantly,” he explained.

That strategy worked. Now, each of his properties produces RM400–RM900 positive cashflow every month, after deducting all expenses including mortgage payments and maintenance. His ROI skyrocketed to 7.5%–8.6%, a huge leap from the 5.8% he initially achieved on his own.

Beyond cashflow, Sean’s net worth and savings grew rapidly, reaching RM120,000 in just over a year.

For Sean, the real transformation wasn’t just financial, it was mental. Through FAR Capital’s community events and property tours, he met other investors from every background: engineers, doctors, lawyers, business owners. All united by a common goal: financial freedom through smart investing.

“These were people I never imagined I’d be learning from,” Sean said. “FAR Capital gave me not just strategy, but confidence and a sense of direction.”

Sean’s journey is just beginning. His next goal?

To build a portfolio of 10 high-performing properties and achieve early retirement through passive rental income.

“With FAR Capital’s guidance — from data analysis to portfolio strategy — I know I can reach that goal faster, with less risk,” he said. “They’re not just a company. They’re my long-term partner in building wealth.”

“FAR Capital gave me clarity, strategy, and the confidence to scale my property portfolio far beyond what I thought was possible. In less than a year, I own five properties with solid ROI. It completely transformed the way I invest.” — Sean, 28, Software Engineer (KL)

Sean’s story is proof that fear fades when you have the right mentor and strategy. If you’ve ever worried about making the wrong financial move, remember this: the only real mistake is not taking the first step.

✅ From fear and zero savings to five properties, six-figure savings, and consistent cashflow — Sean’s journey shows that with FAR Capital, financial freedom isn’t a dream. It’s a plan.

👉 Ready to start your journey?

Join the FIRE Event and learn the same strategies that helped Sean build his property portfolio: https://fire.farcapital.com.my/