Yes, right now you’re earning a decent income. You work hard. You pay your bills. You don’t splurge.

But month after month, you’re still stuck. Living paycheck to paycheck. Carrying debts that never seem to shrink. Praying your job stays stable, because you don’t even have RM1,000 in savings to fall back on.

If this feels personal… it’s because you’re not alone.

At FAR Capital, we’ve met thousands of clients in the exact same position. From private-sector executives to engineers, teachers to doctors — all earning well on paper, but quietly struggling with high debt, low savings, and zero investment.

So, we built a strategy that works in the real world. Not theory. Not budgeting fluff. A clear, practical, step-by-step approach to break out of the debt trap — even if you’re already stretched thin.

First, let’s understand what a debt swap and the debt stretch method are.

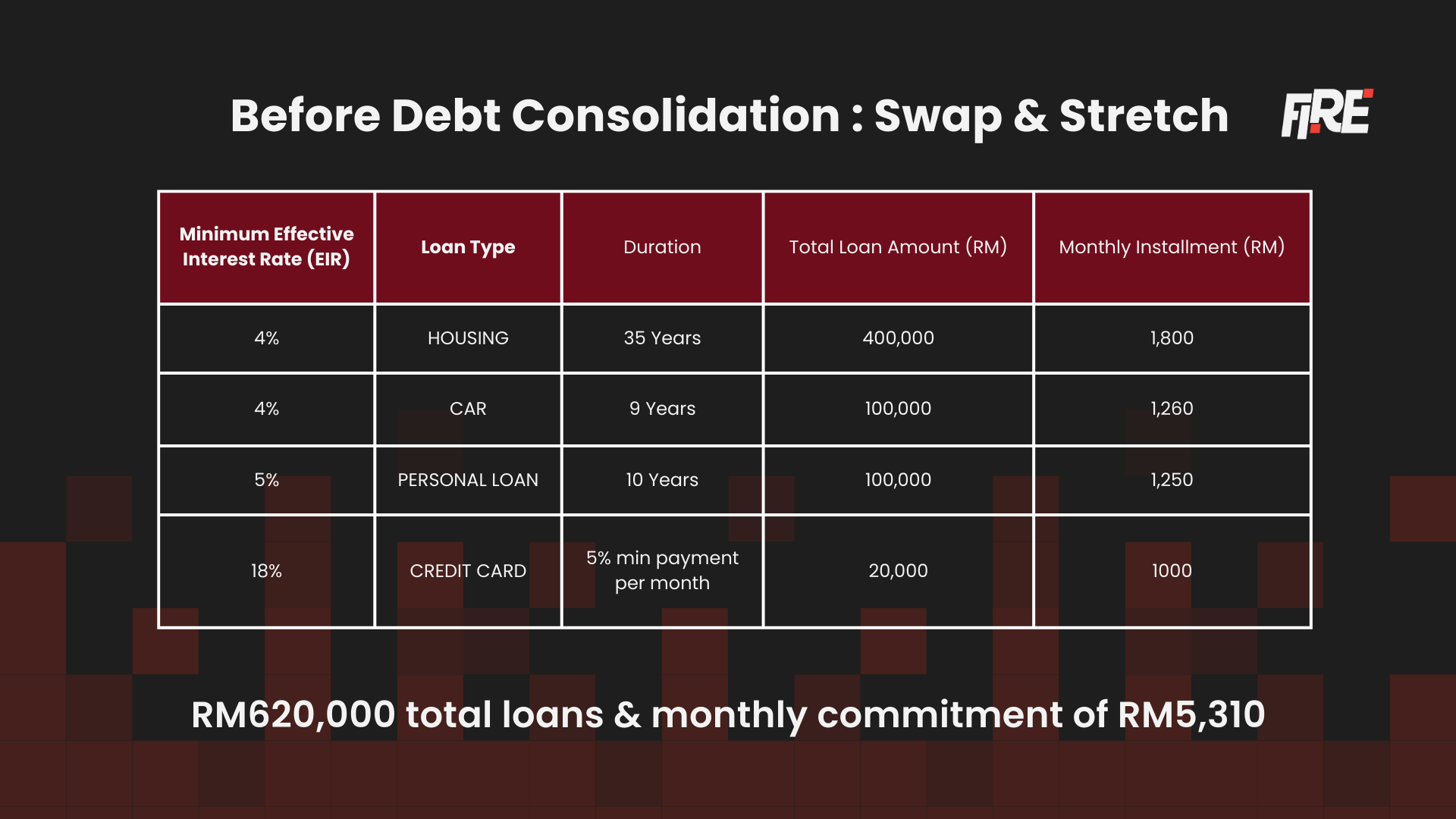

Now, how can you apply this? The first thing that you must understand is that not all debts are equal — but most people treat them the same. Let’s take a look at the table below.

See the difference? Most people try to “pay off everything” emotionally, without a plan.

High-interest credit cards.

Short-term loans.

Commitments stacked on commitments.

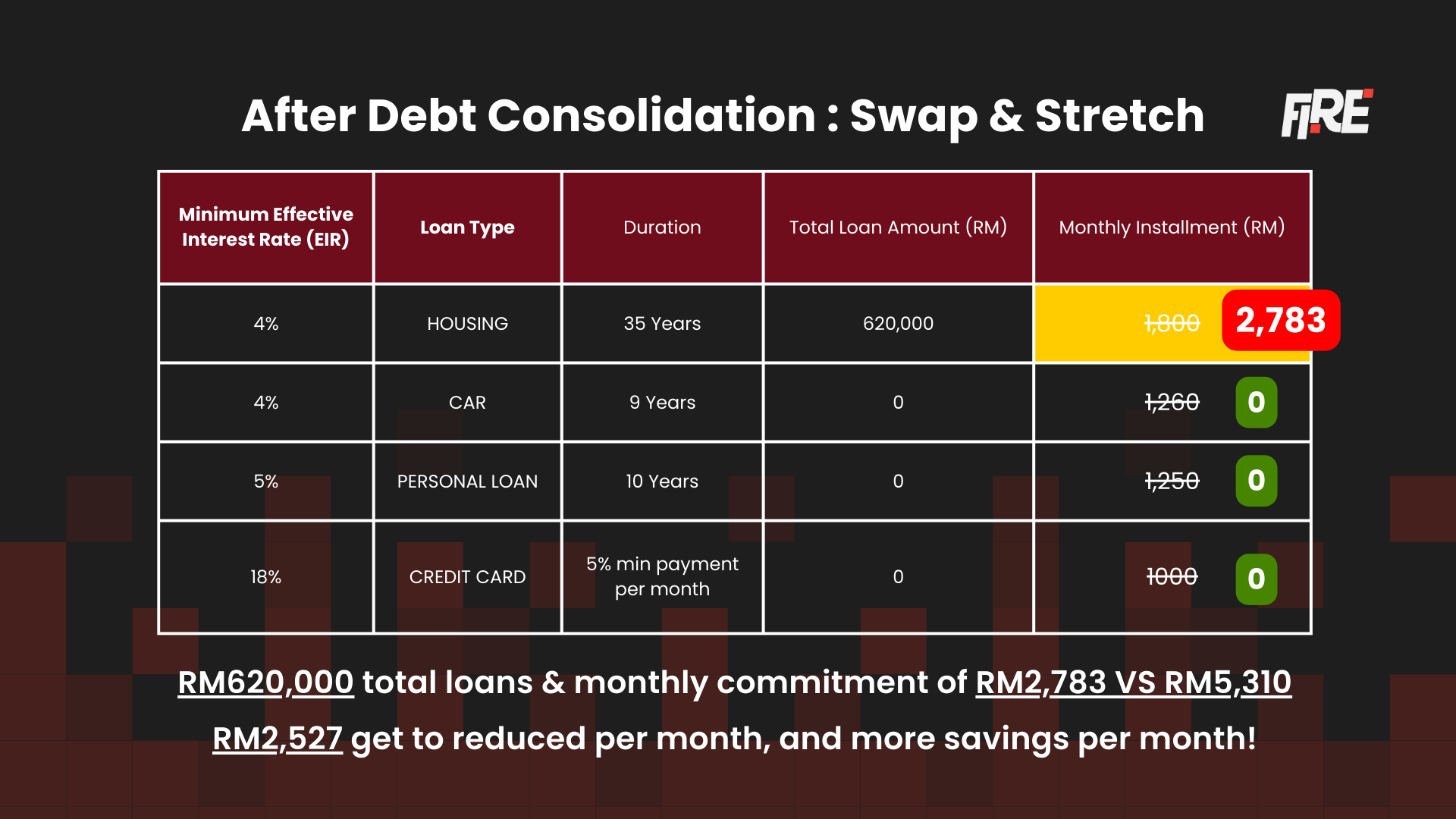

That’s why the first step we teach is debt consolidation — but done strategically (debt swap and stretch method). We replace bad, short-term, high-interest loans with longer-term, lower-cost debt so that you get extra cashflow for savings.

The result?

You have lower commitments.

Breathing room.

And a clear strategy for moving forward.

This is the part that surprises most people:

Yes, you can buy a property to eliminate your debt.

We teach clients how to use zero-capital or cashout property deals to access immediate liquidity, without touching their savings.

Here’s how it works:

🏠 Identify the right property deal that offers 5-6 figures cashout

🏠 Use the cashout to settle credit cards, personal loans, or outstanding debts

🏠 Save some cashout to cover the renovation costs

🏠 Rent out the property to others and get positive cashflow every month

Basically, you get to leverage on property appreciation and bank financing instead of your own pocket. This is not about speculation. It’s about financial engineering. It’s about transferring bad debt into good debt and letting your property work for you from Day One.

Now, this is where the transformation happens. Once the property is handed over, our clients rent it out and generate positive monthly cashflow.

Instead of being the one stuck paying, someone else pays the loan — and they walk away with:

✅ Passive income

✅ Increased savings

✅ Long-term capital gain

✅ And most importantly, a proven wealth vehicle

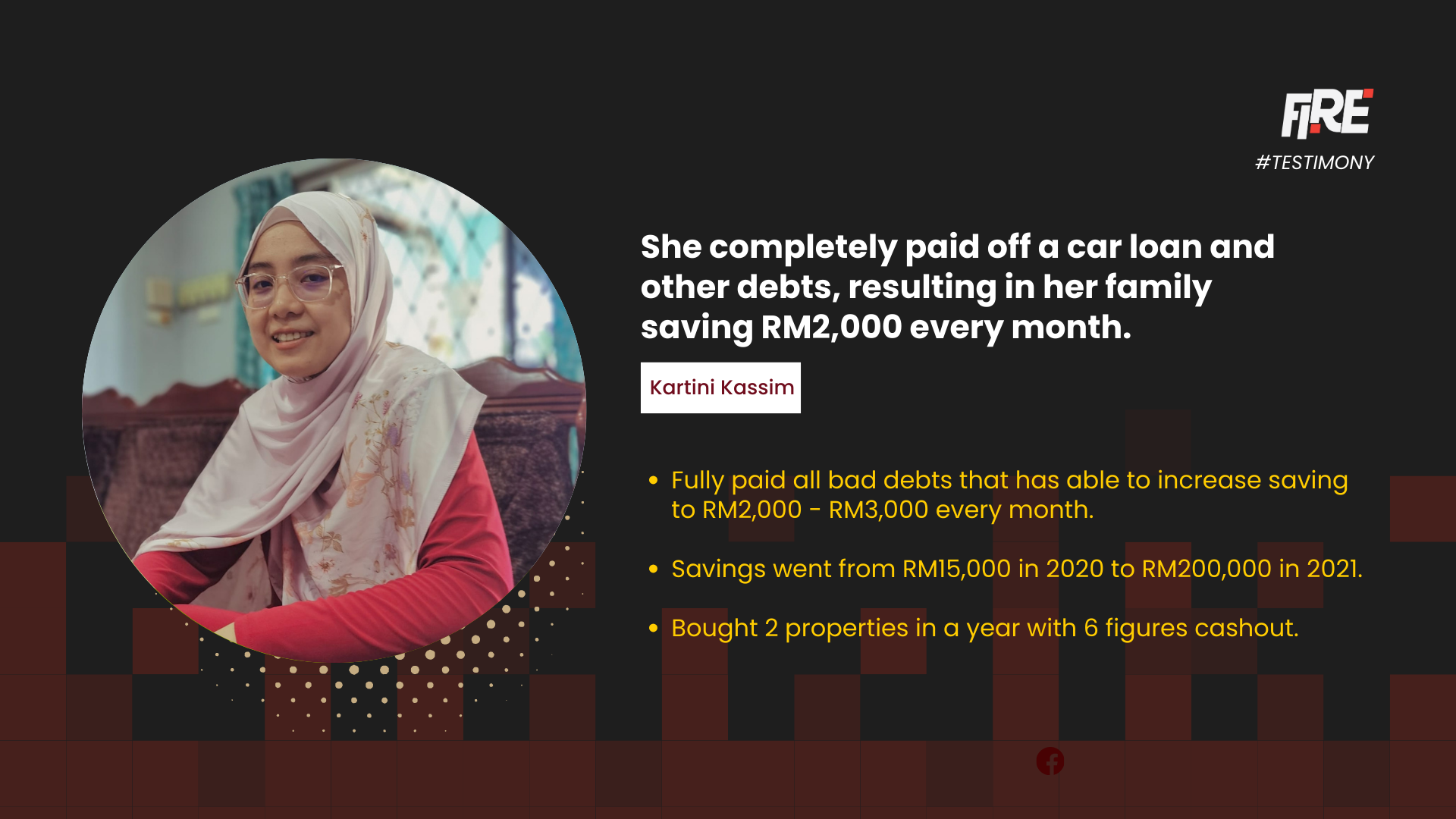

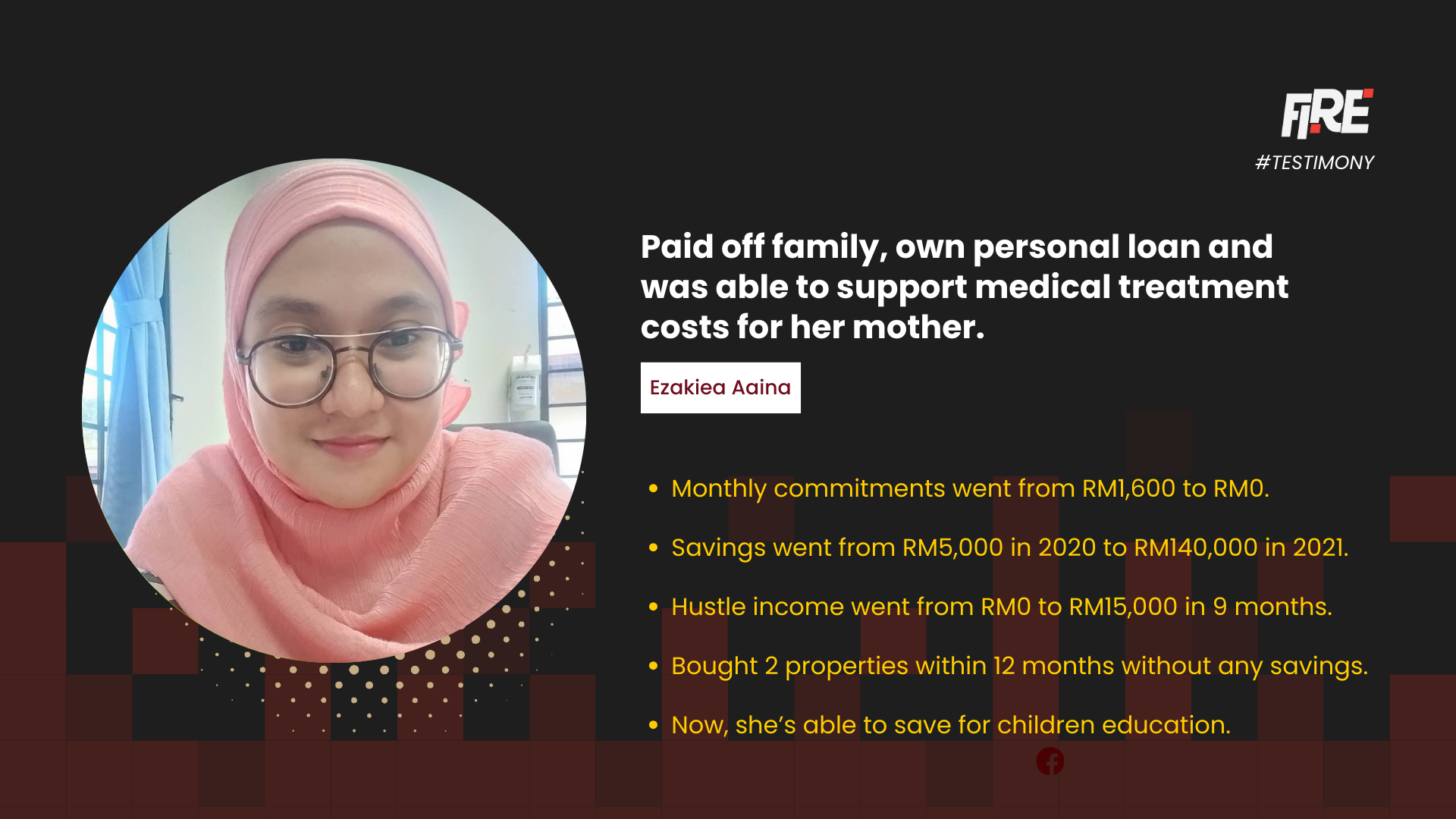

This is how clients who were once living paycheck to paycheck, with high commitments or a few bad debts — have now paid it off, built RM100K in savings, and own a few properties without ever using their own capital.

Yes, this is real.

It just requires the right strategy, right property, and right guidance.

We’ve applied this framework with thousands of clients.

From government servants to MNC managers.

From single-income parents to fresh grads.

Just like you, they felt stuck.

Just like you, they didn’t know where to start.

But they chose to stop waiting — and take action.

If you’re stuck in debt, and worried about what happens if your salary suddenly stops — this framework was built for you.

And the best part?

You don’t need to figure it out alone.

We’re revealing the full breakdown of this 3-stage debt transformation strategy at our upcoming FIRE Event — a one-day, in-person experience for professionals who are ready to reclaim control over their income, debt, and future.

🛡️ FIRE 2025: Financially Independent, Retire Early

📍 YouthCity, Nilai

📅 Sunday | 26 October 2025

🕙 10:00 AM – 6:00 PM

🎟️ RM100 (1 pax) | RM149 (2 pax)

Come learn the exact playbook that helped everyday Malaysians clear debt, build savings, and buy property with zero capital — even during an economic crisis.

This isn’t a motivational talk.

It’s a battle-tested strategy that works.