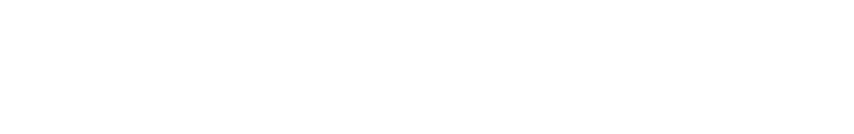

Is this you? Do you wake up every morning feeling the heavy burden of debt pressing down on your chest? You keep having the sleepless nights wondering how you’ll make ends meet.

You work so hard, earn income, pay your debt and somehow, at the end of the day, you don’t have savings at all. The salary is the same but everything else is getting higher. Moreover, it’s so frustrating that you don’t see a way out.

Not only that, all kinds of problems arise in married couples and families, so much so that they cannot enjoy life due to debt.

So, if you:

☑ Are tired of paying debt every month,

☑ Had to dig here and there to pay,

☑ Can’t sleep at night, worried about debt,

☑ Can’t give the best for the family,

☑ Wonder when your debt will be settled,

☑ Have no savings & various problems arising,

There is hope! There’s a way out.

A solution so powerful, it can transform your financial situation in a year.

Imagine waking up free from the shackles of bad debt, with a clear path to financial stability and peace of mind. This isn’t a dream, it’s a reality that can be yours.

We have conducted thousands of sessions (online and offline) for clients who have high monthly commitment to get out of their problem within 36 months.

All the issues often happen because of a lack of understanding of personal finance and how to manage debt effectively. Without the right knowledge, you will be stuck in a cycle where your entire salary is used to cover debt payments.

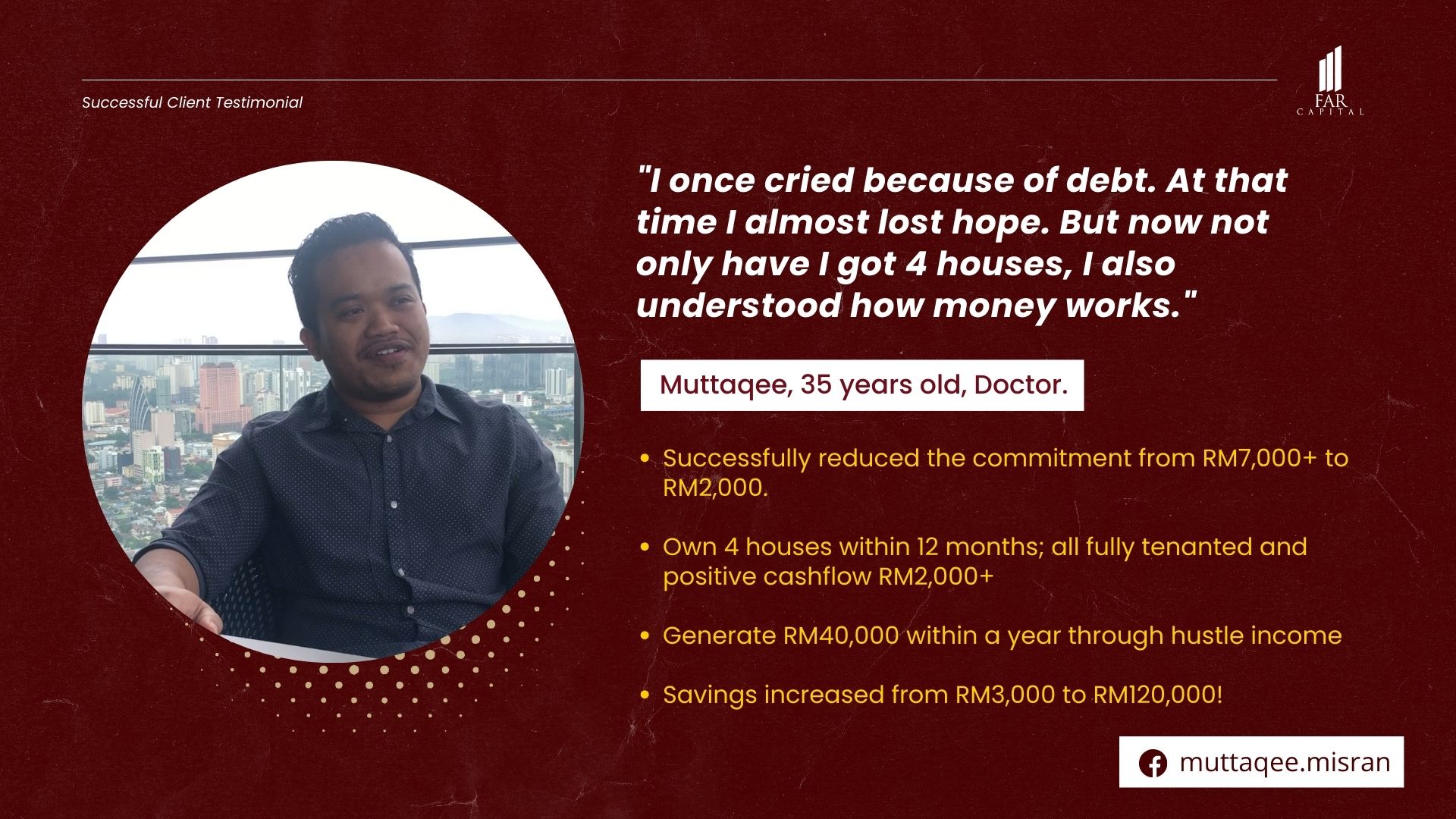

However, not for FAR Capital clients.

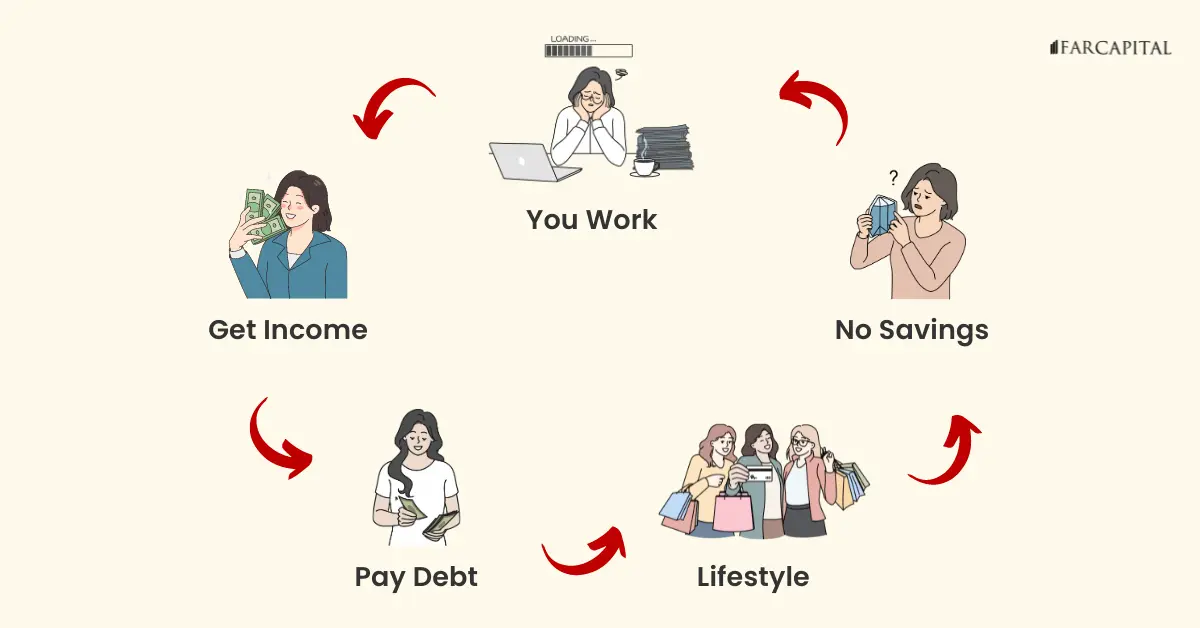

Dr Kartini Kassim managed to settle her father’s credit card debt. She even opened her own clinic without making any more loans.

Noradila Salmi managed to settle a personal debt of RM78K, credit card debt and 2 car debts.

The reason why these people managed to reduce bad debt is that they applied these 3 strategies.

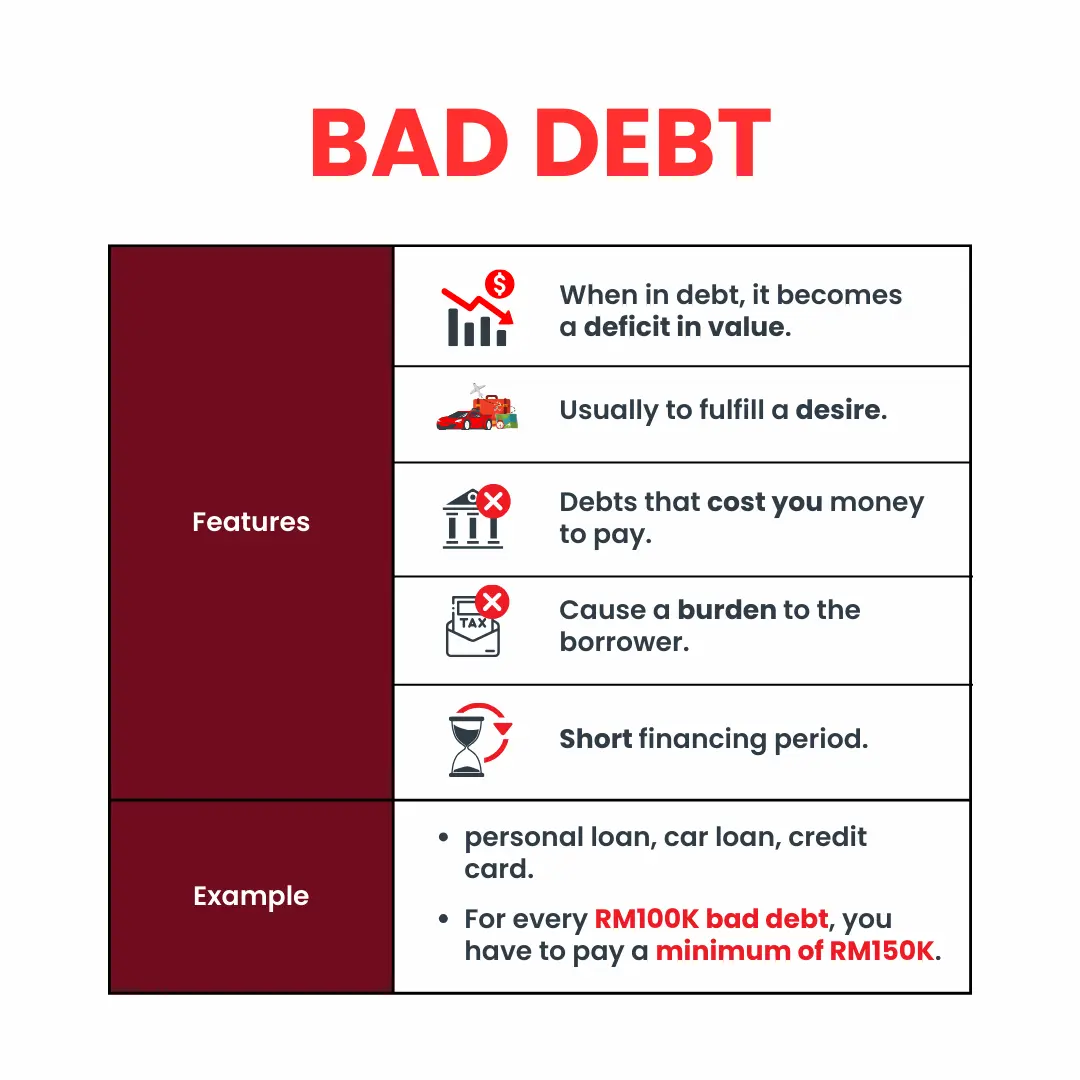

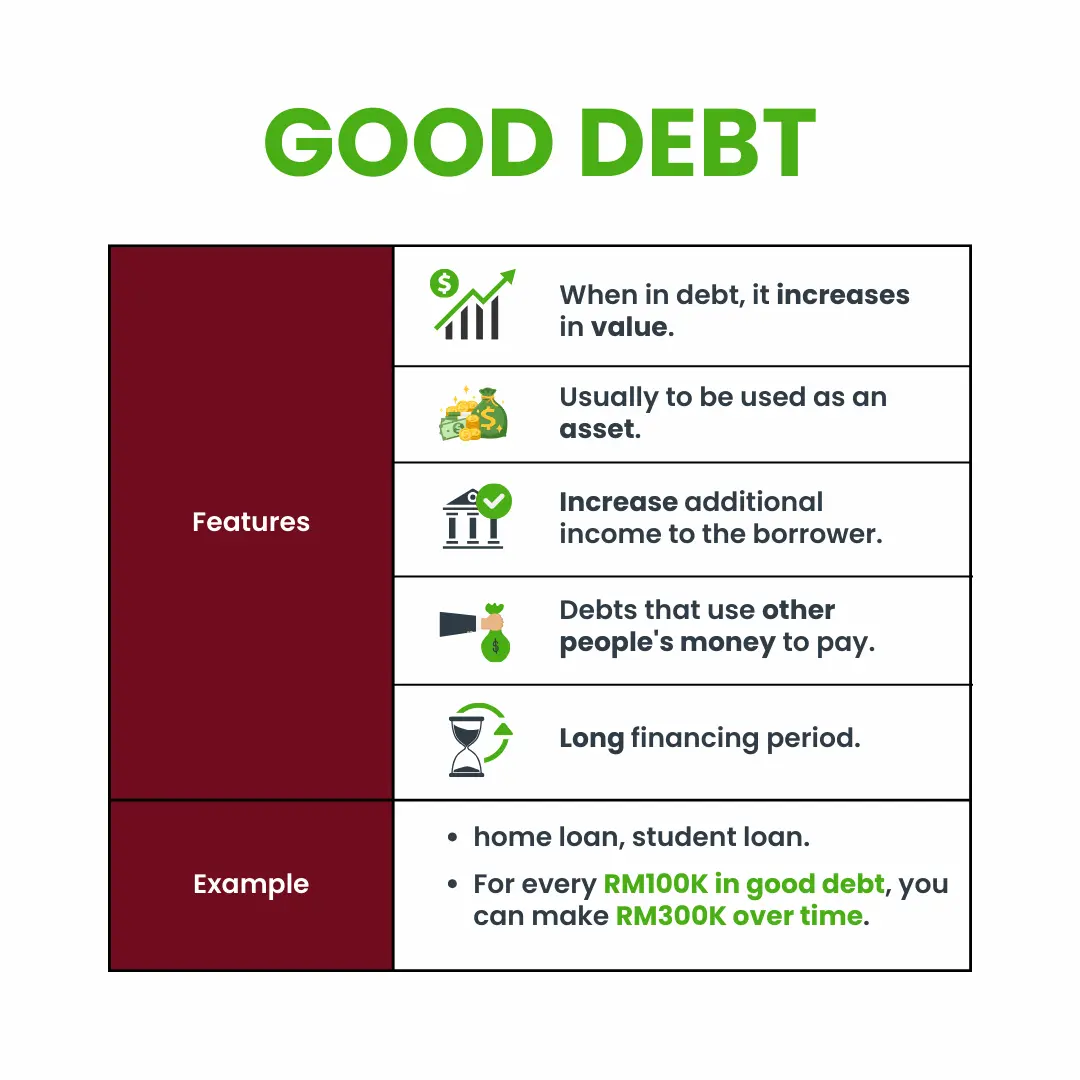

The truth is, not all debt is the same. Bad debt does not make you rich, good debt has the potential to do the opposite. With every good debt that the 1% takes on, our income goes up.

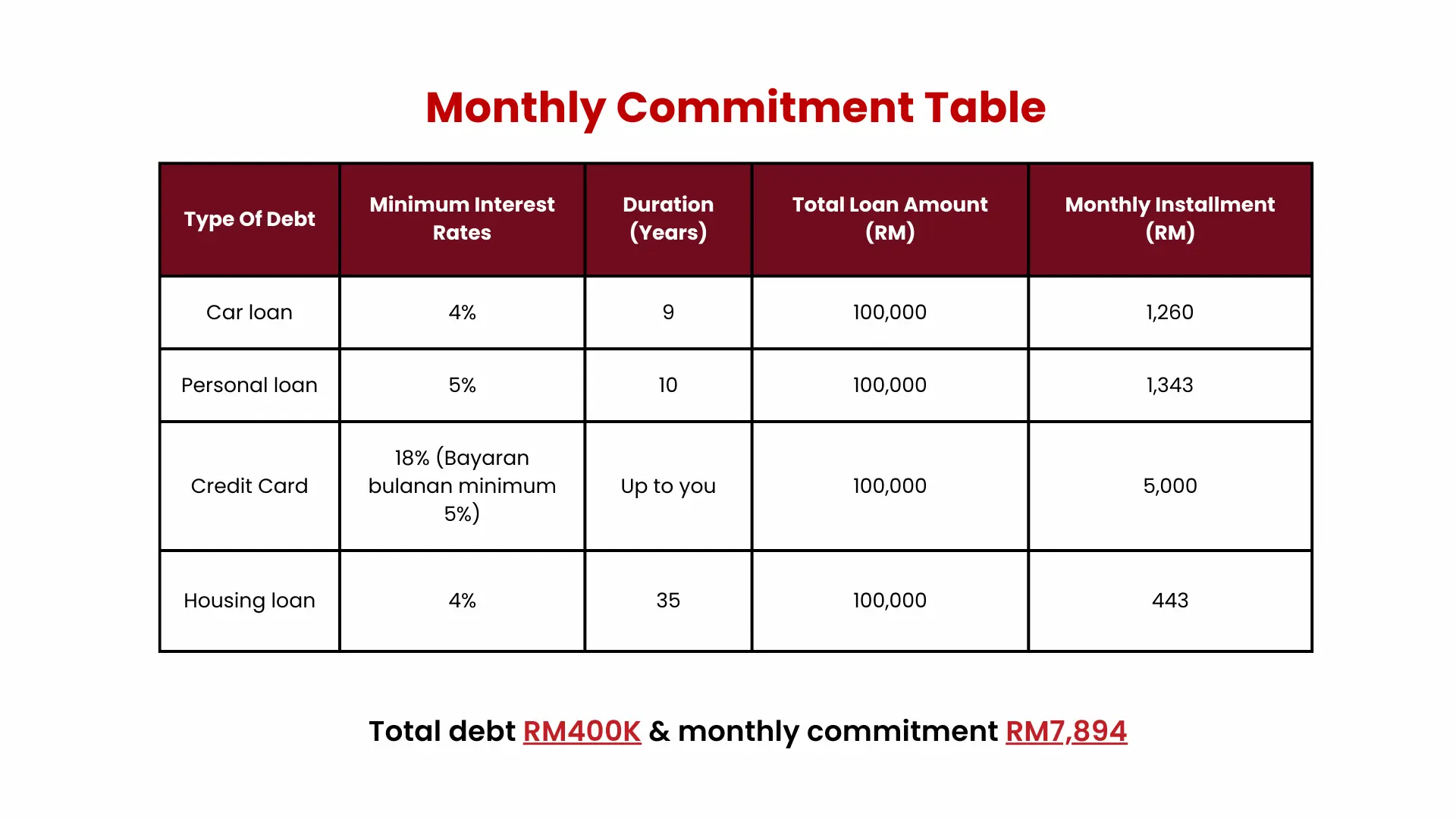

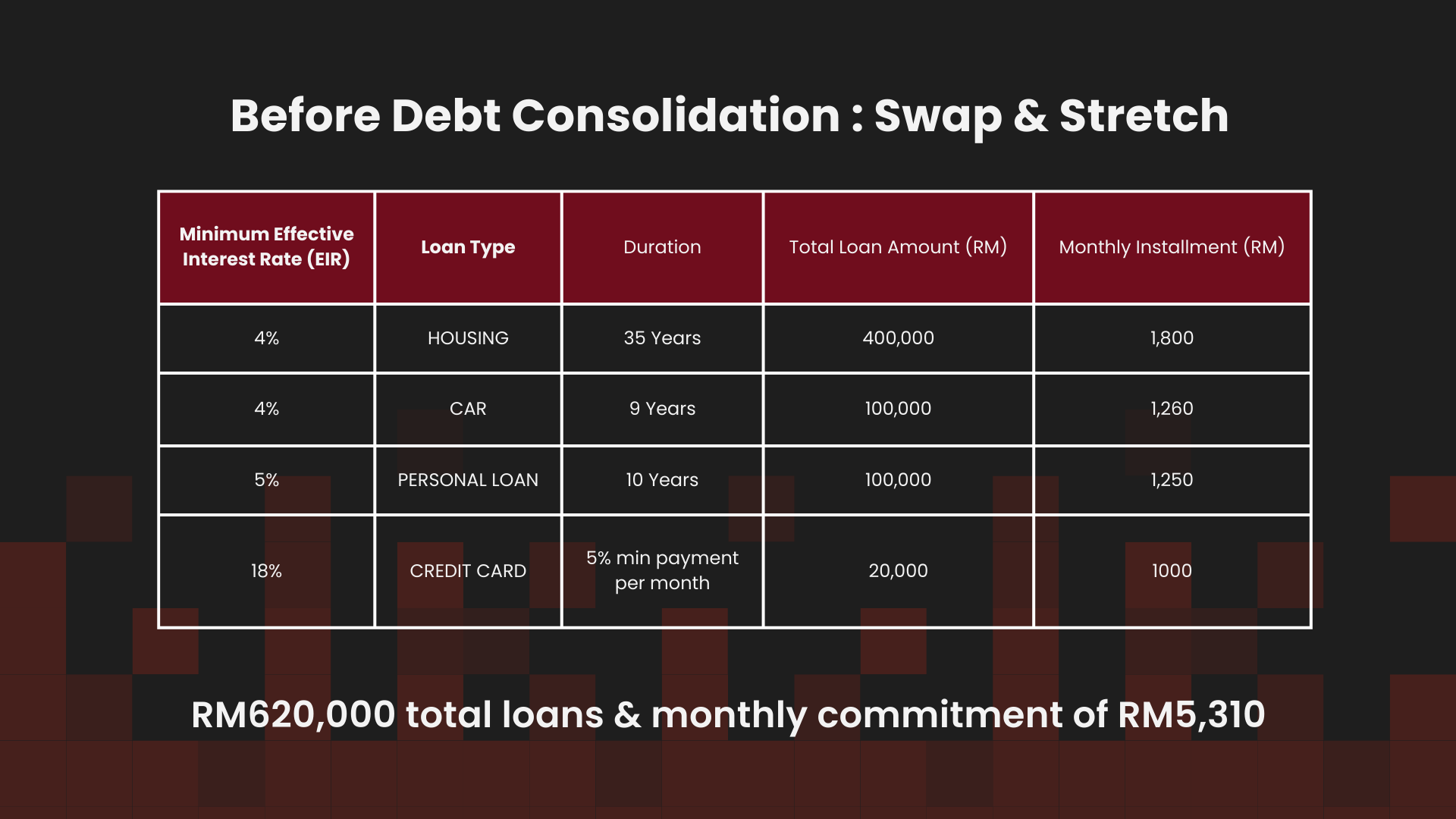

Now, look at the Monthly Commitment Table for all types of debt.

All types of debt have different interest rates even if the loan amount is the same. What can make you miserable is the high-interest rate and the short payment period.

By understanding this difference, you can prioritise paying debts that have high interest rates first. It will save you a lot of money in the long run.

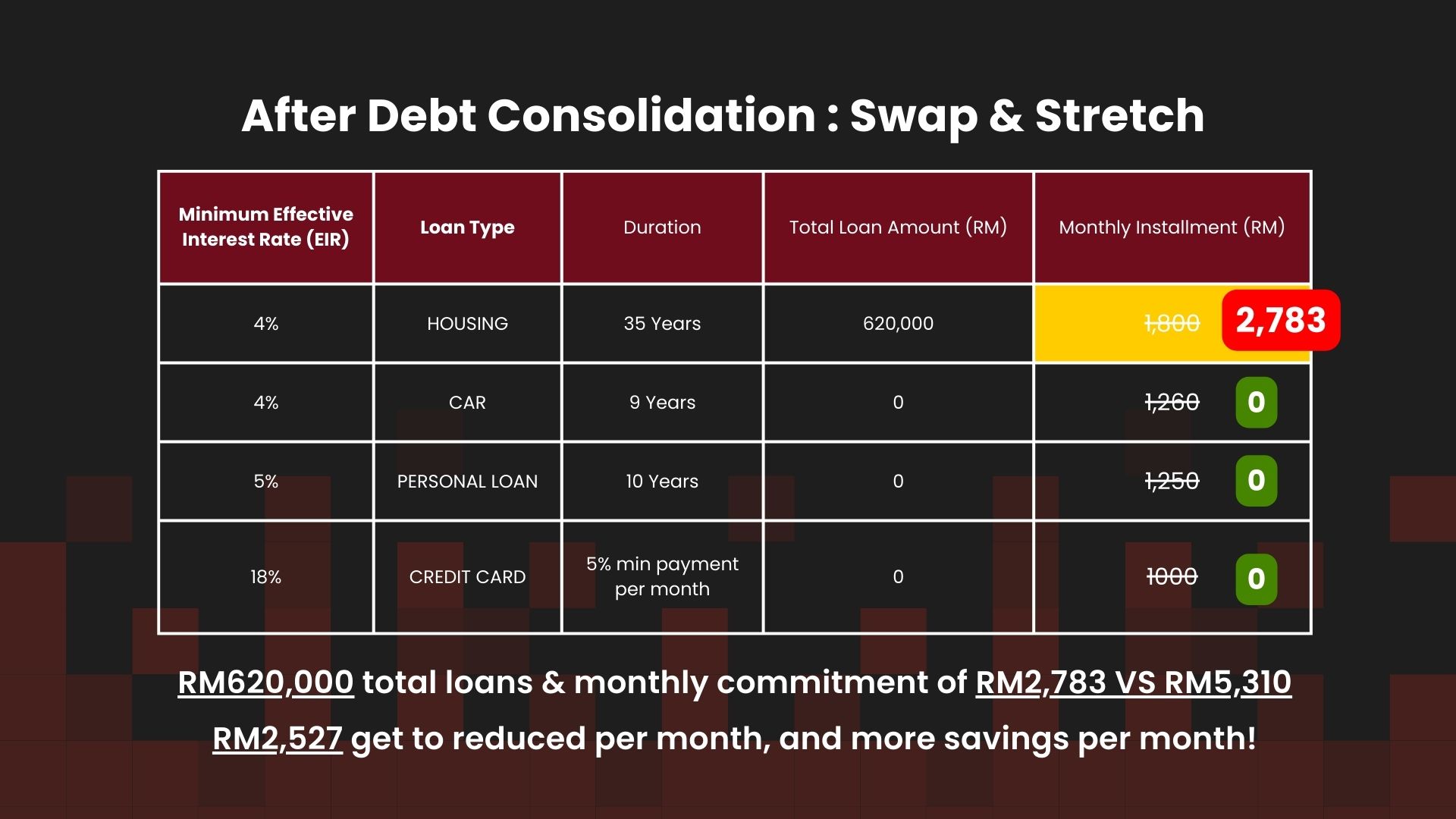

Understand that this concept can be a powerful tool for debt consolidation and reducing your overall financial burden, swap and stretch method.

The question is, how do we do it?

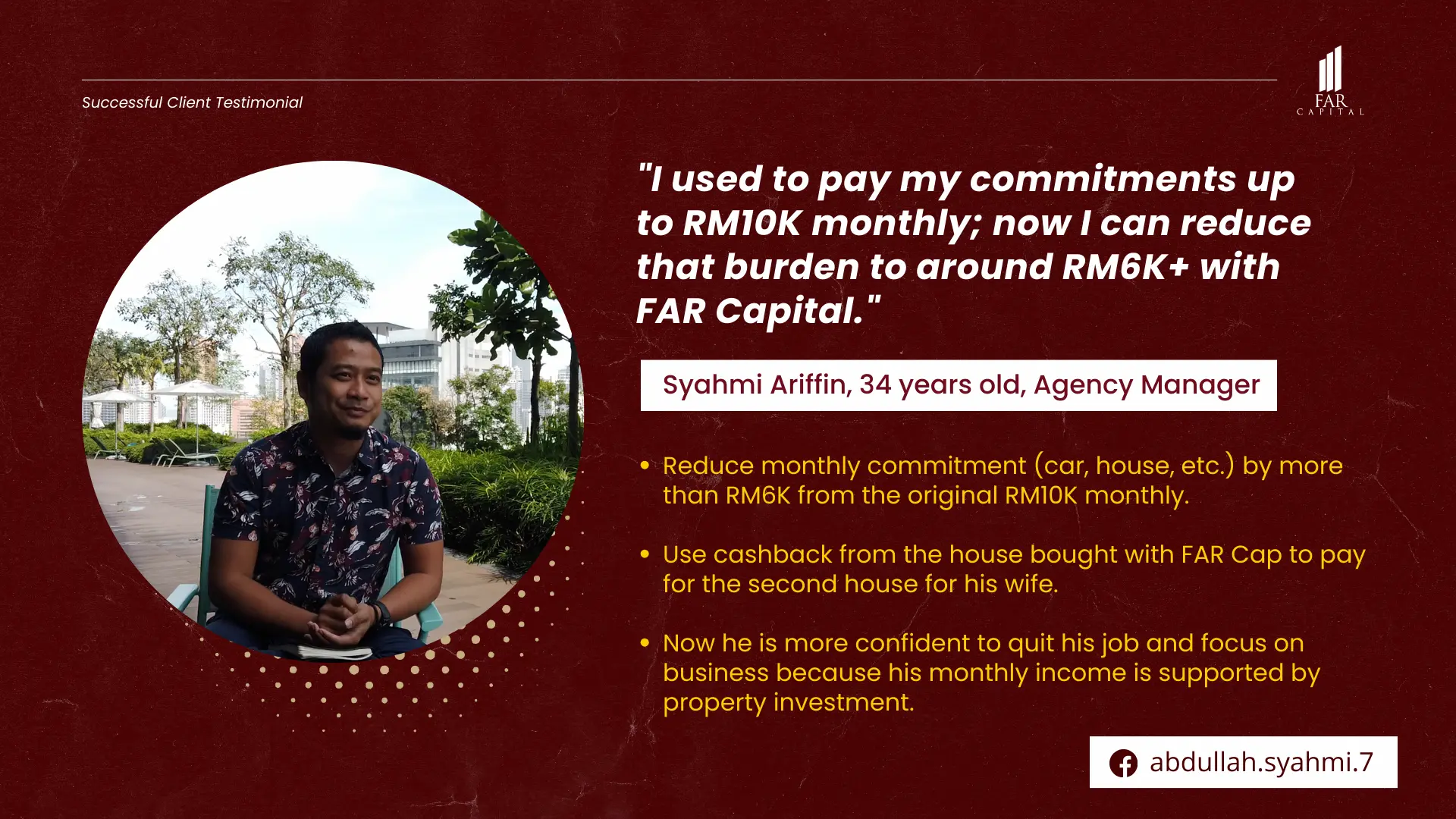

When you have an unfair advantage, which is to buy a property that offers cashout and positive cash flow every month, it can be the best tool to consolidate all your bad debts and reduce your financial burden.

Through unfair advantage, you can buy real estate that can solve all your bad debts. This is what you will get when you have an unfair advantage:

With the careful selection of properties by the FAR Capital team, you can take advantage of these advantages to pay off existing debt while building long-term wealth.

Learn how to buy the right property to ensure that your monthly installment is paid by other people. This formula will ensure that you win and do not lose when buying a property.

The property must meet these 3 criteria which are:

Other than that, you have to have various plans for your property so that you don’t worry about cashflow.

That’s all!

We have revealed to you the guidelines of how our clients do it.

If you want to be like our clients, zero bad-debts, buying property with low capital, building RM100K savings, and learning the real strategies that saved their finances, this is your chance.

Join us at the biggest FIRE Event this coming 26 October 2025. Come and connect directly with real people, real investors who’ve gone through ups and downs, and learn the secrets they used to build financial freedom through Malaysian property investment.

Don’t wait until life tests you, take action now!

👉 REGISTER FOR FIRE HERE