It’s midnight and you’re wide awake worrying about money. Your heart skips a beat every time an “urgent meeting” email pops up from HR. You dread the end of the month because the paycheque that just came in is nearly gone, swallowed by bills and loan payments.

If this sounds familiar, you might be what we call a “Job-Dependent Professional”, a middle-income employee living paycheque to paycheque with no financial safety net. And you’re not alone.

In fact, 55% of Malaysians spend all or more of their monthly income, essentially living paycheque-to-paycheque, and a whopping 84% do not set aside any fixed savings each month.

This article will dive into the struggles people like you face, the very real fears that keep you up at night, and most importantly, how to break free, how to build financial security and achieve financial freedom so you’re no longer utterly dependent on that next paycheque.

Meet Zainudin, a 30-year-old executive in Kuala Lumpur earning around RM5,000 a month. On paper, that income sounds comfortable. But he has no savings to speak of, he’s lucky if his bank balance isn’t back to RM0 by the 15th. Why?

Nearly half of his salary goes to “bad” debt, credit card bills, a personal loan he took out for an emergency, and a car loan. He’s not investing a single sen because nothing is left by month’s end. This is the harsh reality for many middle-class Malaysians.

Surveys show 70% of Malaysians save less than RM500 a month or nothing at all, meaning most people have little to no cushion if something goes wrong. It’s no wonder over 65–70% of younger Malaysians (Gen Z and Millennials) say they’re living paycheque to paycheque too, constantly anxious about making ends meet.

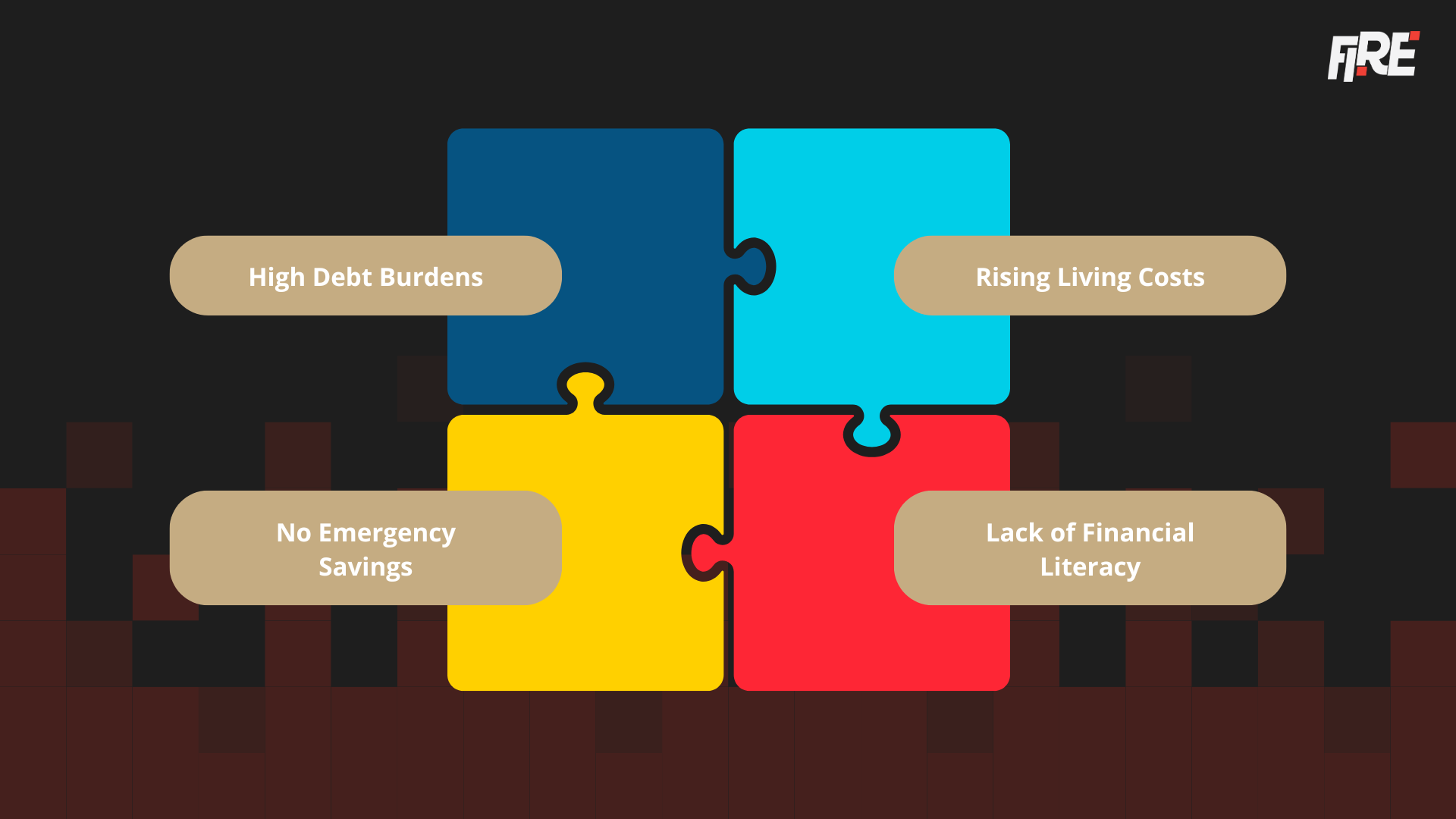

Why is this happening? Several factors trap hardworking professionals like Zainudin in a financial tightrope walk.

The result?

A constant feeling of being on a treadmill you can’t get off.

You work hard and earn a decent salary, yet nothing is left at month’s end, and you’re one surprise expense away from financial trouble. It’s a frustrating, demoralising place to be and it sets the stage for those creeping fears that something could knock it all down.

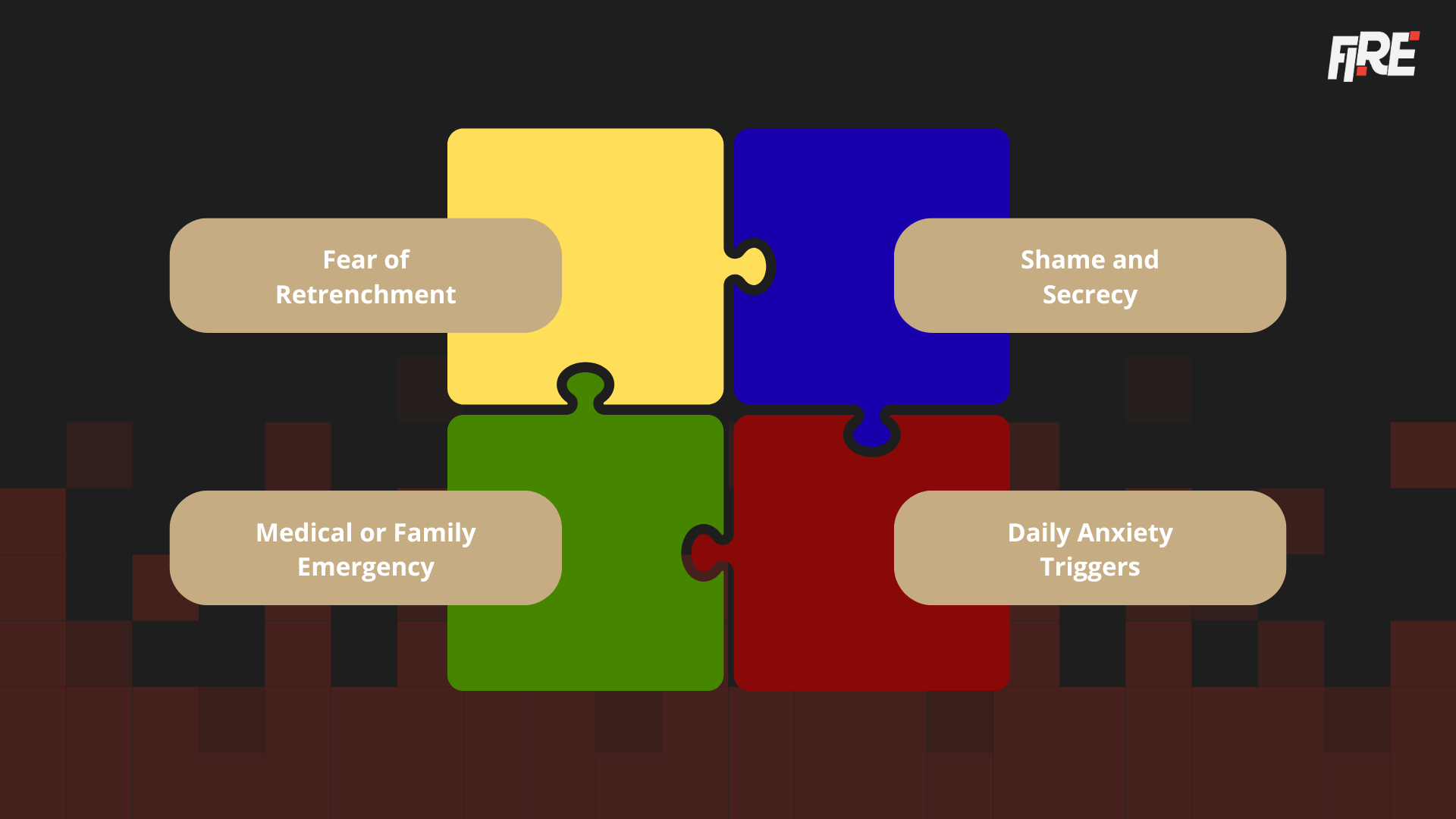

Living paycheque-to-paycheque isn’t just a financial issue, it takes an emotional and mental toll. When you’re a job-dependent professional, your entire life is built around that single income source, and the thought of losing it can be terrifying.

Here are some of the common fears that keep people like Zainudin (and maybe you) up at night, along with why those fears are very valid…

These fears are powerful, and they’re not unfounded. Living without a financial buffer is like walking a tightrope with no safety net below. One slip, and the consequences could be dire. Every day, you’re effectively gambling with your future. As Zainudin often thinks, “All it takes is one bad month, and I’ll have to borrow money or sell something just to survive.”

But here’s the thing: while the risks are real, there is a way out. Thousands of Malaysians have started recognising that this unstable way of living must change, and they’re taking steps to regain control. It’s not easy, but it is absolutely possible to go from financially vulnerable to financially secure.

Let’s talk about how.

Financial freedom sounds like a dream when you’re stuck in the paycheque-to-paycheque grind. But what does it really mean?

At its core, financial freedom is about having choices. It’s having enough savings, investments, and alternative income so that losing a job wouldn’t immediately flip your life upside down. It’s the ability to weather emergencies without panic, to leave a toxic job if you need to, and to know you’re steadily building wealth for the future.

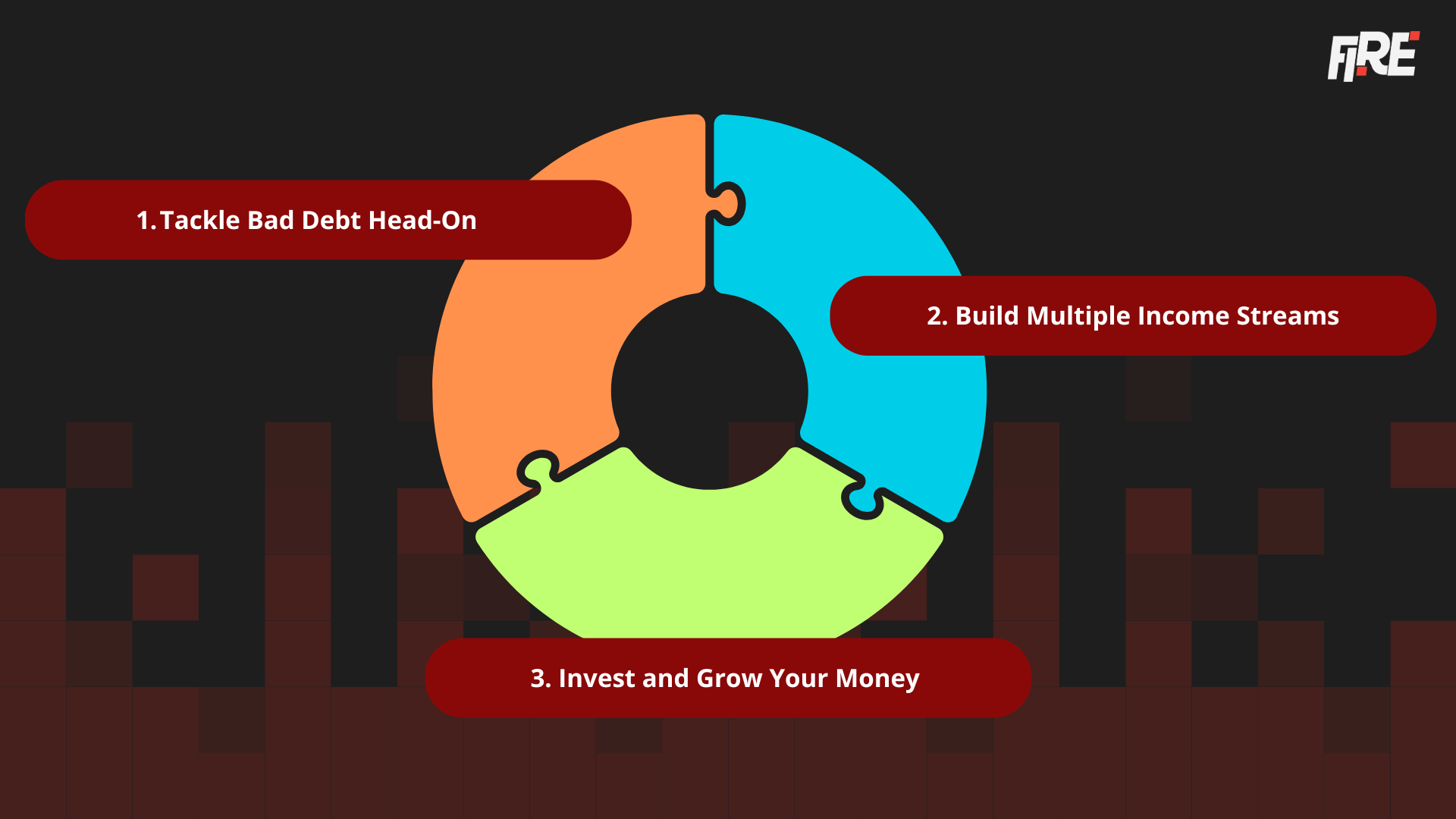

How do you get there from where you are today? Here are 3 practical steps to start moving toward that goal.

It’s hard to get ahead if you’re dragging a ball and chain of high-interest debt. Make a plan to attack your bad debts (credit cards, personal loans) systematically as high-interest debt is a wealth killer. Those interest payments are money not going into your future.

Plus, once a debt is paid off, that monthly payment becomes free cash flow you can then direct to savings or investments. Imagine no longer seeing a chunk of your salary vanish to the bank each month, that’s liberating!

(On the flip side, avoid taking new bad debts. If you’re tempted to finance a new gadget or car you can’t afford, remember how hard it is to get out of debt once you’re in it.)

Read here to know about debt swap & stretch method >

If your entire life hangs on one paycheck, the obvious solution is to diversify your income. Think of it like not putting all your eggs in one basket. Could you start a side hustle or part-time gig to earn extra money?

Many Malaysians are doing exactly that, over 60% of Gen Z and millennial workers here have a second job or side income now to cope with expenses and build savings. Whether it’s freelance work (writing, graphic design, programming), doing Grab or food deliveries after work, monetising a hobby (baking, crafting, tutoring), or a small online business, any extra income helps.

Even an additional RM500–RM1000 a month can accelerate your debt payoff and beef up your savings. Plus, a side gig can eventually grow into something that might replace your job’s income (many businesses start as side hustles!).

Passive income is another stream to aim for, money that comes in with minimal daily effort. This could be from investments like stocks (dividend income), renting out a room or property for rental income, or even royalties from creative work.

Multiple income streams act as your personal “insurance” against job loss. If one income source falters, you have others to support you. Over time, who knows, you might even shift from being job-dependent to financially independent, where working becomes a choice, not a necessity.

Saving money is crucial, but with inflation, you also need to grow your wealth to truly get ahead. Once you have your debts under control and an emergency fund in place, start learning about investments that can generate returns above inflation, such as stocks, bonds, unit trusts, or property.

Investing can sound intimidating, but you can start small. For example, even RM100 a month into a low-cost index fund or robo-advisor can, over years, compound into a significant amount. If you’re interested in property, you might begin by learning how some investors acquire properties with positive rental cash flow (so the rent covers the loan and then some).

The key is to make your money work for you, so eventually you’re not solely trading hours for ringgit. Many who achieve financial freedom swear by the principle of paying yourself first (investing a chunk of income every month before anything else).

Over time, as your investments grow, you get closer to that ideal point where returns or passive income could cover your living expenses. That is essentially the endgame of financial freedom, when your money generates more money, giving you the option to retire early or pursue work you’re passionate about without worrying about the paycheque.

———–

Every one of these steps requires changing habits and mindset. It won’t happen overnight. But each step you take will reduce your financial stress and increase your resilience.

Imagine: with a few months of expenses saved, you’d sleep better at night. With no credit card debt, you’d keep more of your salary each month. With a side hustle bringing in extra cash, that “urgent meeting” email might not scare you as much because you know you have a Plan B. Bit by bit, you move from being in survival mode to having options.

As you work on improving your finances, it helps to have a big-picture goal to motivate you. One powerful framework that’s gained popularity is FIRE: Financial Independence, Retire Early. Now, retiring early in your 40s may or may not be your personal goal, but the essence of FIRE is achieving financial independence as early as possible so that you aren’t forced to depend on a job.

It’s about reaching a point where your investments and savings generate enough income to cover your expenses, meaning work becomes optional. Even if you don’t retire early, hitting financial independence gives you freedom. Freedom to choose work that you find meaningful, to take a sabbatical, or to start a business without worrying about starving.

The FIRE mindset is also about intentional living, spending on what truly matters to you and cutting out what doesn’t. It’s not about depriving yourself of all joy; it’s about ensuring your money is aligned with your values and long-term plans.

For a job-dependent professional, adopting some FIRE principles can be life-changing. It encourages you to think beyond just surviving this month to planning for a future where money is a source of security, not stress.

Reading about these steps and strategies is a start, but the real change comes from taking action. Breaking out of the paycheck-to-paycheck cycle can feel daunting, but every journey begins with a single step.

Importantly, you don’t have to do it alone. Get support and knowledge wherever you can. So, if you’re ready to break free from paycheque pressure, consider attending the upcoming FIRE (Financial Independence, Retire Early) event.

It’s a special one-day program designed for people exactly in your situation, those who want to build a security buffer, kill off bad debts, and create new income streams so they can sleep soundly at night.

You’ll learn proven strategies (a 3-stage roadmap, from building that first RM100k in savings to generating passive income) from experts who have helped many others attain financial security.

More importantly, you’ll meet others on the same path, so you know you’re not alone in this journey. (The event is on Sunday, 26 October 2025, 10:00 AM – 6:00 PM at YouthCity, Nilai – mark your calendar!)

Imagine yourself a year from now, you’ve paid off a chunk of your debt, you’ve got a few months of expenses saved up, maybe you even have a side hustle boosting your income. You no longer flinch when HR calls, and you don’t lie awake every night in a cold sweat about money. That vision can become reality with consistent effort. The sooner you start, the quicker you’ll feel the weight lifting off your shoulders.

Don’t let fear paralyse you. Use it as fuel to make a change. The fact that you’re worried about your finances means you care about your future and that’s good.

Now take that concern and channel it into a plan of action. Your journey from financial fragility to freedom begins now. Take the first step, and before you know it, you’ll be well on your way to escaping the paycheque-to-paycheque trap for good and living life on your own terms. You’ve got this.